Do I Have a Competitive Advantage?

By: Joe Brady, Director

The value of a business depends on its ability to generate and sustain returns on invested capital (“ROIC”) and the capacity of the business to grow over time. Therefore, understanding and predicting what drives and sustains ROIC is critical to evaluating investments and business strategies. The ROIC of any company or industry can be explained by its competitive advantage (or lack thereof). But what exactly drives a company’s ROIC, and how can managers measure and manage it over time?

If a company earns a high ROIC, it either charges a price premium or produces/distributes its products more cost effectively than its competitors. To analyze the potential sources of competitive advantage, we can disaggregate the equation for ROIC to determine whether a company’s ROIC is driven by its ability to maximize profitability or optimize capital turnover.

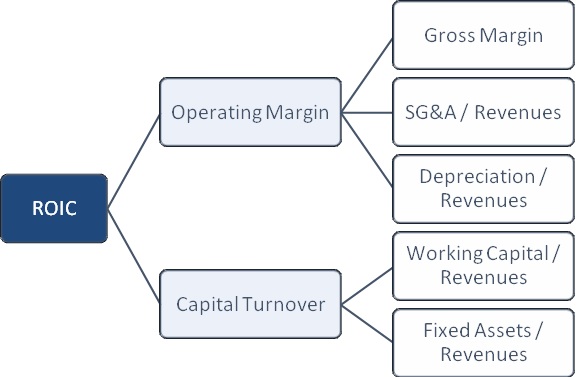

Exhibit A: Return on Invested Capital Tree

Exhibit A shows how the components can be organized into a tree; each of these components can be further disaggregated to enable a line item by line item analysis of a company’s ROIC. After determining the drivers of a company’s ROIC, we can combine this with an analysis of industry structure and a qualitative assessment of the company’s strengths and weaknesses to determine its competitive advantage over its competitors.

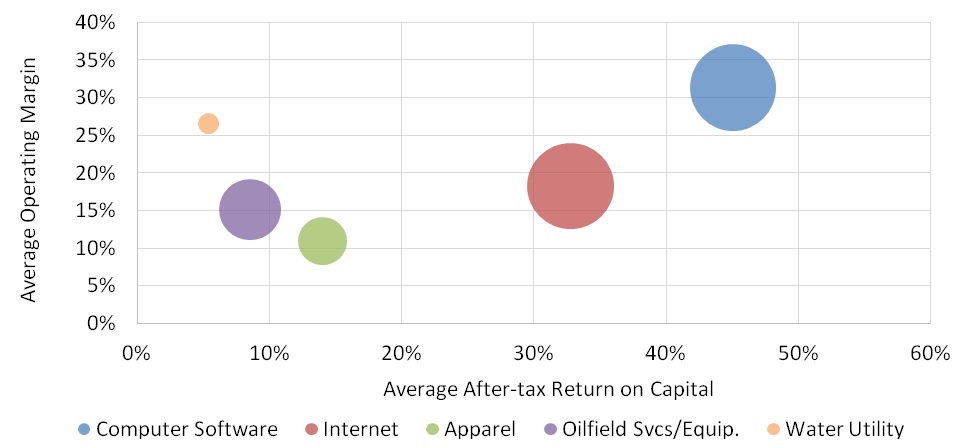

It is important to remember that industry dynamics is a chief driver of competitive behavior, and therefore greatly influences the performance and returns of its constituents. ROIC varies greatly among industries due to differences in inherent industry characteristics, which highlights the importance of benchmarking companies against competitors. Exhibit B below compares the returns on capital and operating margin of select industries, with the size of the bubble indicating the number of constituents in each industry.

Exhibit B: Industry Structure Comparison

Source: NYU Stern School of Business

Though the performance of companies in all industries will vary with the business cycle, companies in commoditized industries will rarely reach the levels of those industries with more defensible structures. The Internet & Software industries, for example, often offer innovative products that are either protected by intellectual property rights, generate recurring revenue through subscription based services, and/or involve high switching costs for customers. In the Apparel industry and other consumer products industries, certain companies have developed long-lasting brands that have customer loyalty and make it difficult for new competitors to compete. By contrast, more commoditized industries such as Oilfield Equipment and Services, or the Water Utility industry at the far end of the spectrum, offer undifferentiated products and services which prevent constituents from building a sustainable competitive advantage.

In summary, there are a lot of factors that affect a company’s ability to create and sustain a competitive advantage. Investors tend to reward companies generating outsized returns versus competitors with higher valuations. While we can measure a company’s ROIC and its various components, a company’s performance always needs to be viewed through the lens of its industry structure and combined with a qualitative analysis of competitive position.

Founders Investment Banking (Founders) is a merger, acquisition & strategic advisory firm serving middle-market companies. Founders’ focus is on oil and gas, industrials, software, internet, digital media and healthcare companies located nationwide, as well as companies based in the Southeast across a variety of industries. Founders’ skilled professionals, proven expertise and process-based solutions help companies access growth capital, make acquisitions, and/or prepare for and execute liquidity events to achieve specific financial goals. In order to assist Founders Investment Banking with securities related transactions certain Principals are registered investment banking agents of M&A Securities Group, Inc., member FINRA/SiPC. M&A Securities Group and Founders are not affiliated entities. For more information, visit www.foundersib.com.