Oil & Gas Services Mid-Year M&A Review

By: John Ortstadt

Current Market Commentary

Strategic and financial buyers have been slow to move on acquisitions in 2015. In light of renewed uncertainty in oil prices, we expect buyers to remain patient in their approach of potential acquisitions. The conservative strategy limits a buyer from capitalizing on discounted valuations, but protects them from additional risk exposure and allows efforts to be focused on existing activities. Further straining the industry’s access to capital, bank financing has been limited as lenders look to avoid ownership of oilfield assets with low liquidation values. That said, there are examples of private equity firms actively seeking companies who have been forced to sell in response to the current environment.

Valuation Trends

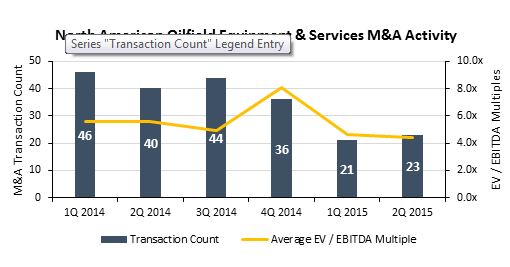

Similar to other Oil & Gas downturns, the 1st half of 2015 saw lower transaction activity and discounted company valuations. We expect continued weakness for valuations of equipment and service companies through the 2nd half of the year as the industry battles low commodity prices.

- 44 transactions in 1H15; a 49% reduction in activity from 1H14 (96 completed transactions)

- Average EBITDA multiple of 4.4x in 2Q15; a 27% discount from 2014 (average valuation of 6.0x)

Conclusion

After the oil supply shock of 2014 ran its course, renewed confidence began to develop this summer as oil (WTI) prices climbed into the $60 range from April to June (2015). When the dust settled, OFS companies were starting to find their footing within the new norm. But, with OPEC running production wide open, and with demand worries out of China (2nd largest oil consumer), many of the previous projections that OFS M&A activity would experience an uptick in the back half of 2015 have changed with the recent developments in oil prices. Both private equity and strategic buyers have remained gun-shy in moving forward with potential deals, thus pushing out any likely increase in M&A activity into 2016. Joe Brady, Director of Founders Oil & Gas Services Team, recently commented on an industry call, “For strategic and financial buyers, the uncertainty and risk in the market continues to outweigh the opportunities. Unless there is a strong strategic fit, there is not a significant appetite for acquisitions. Many companies have simply put M&A on hold and redeployed resources to focus internally.” Mr. Brady also added, “Whereas we originally had a price drop driven by oversupply, now we are concerned about weakness on the demand side. It’s a tough road out there, but we know that the strong [oilfield] companies will figure out how to survive and come out better equipped on the other side. Once the tide turns, there will be tremendous opportunities for companies that are healthy and prepared. We see a compelling time for capital that has been on the sideline to get back in the game. This may have pushed out a quarter or two due to recent events, but the capital is still there needing to be invested. Just as the oil industry has cycled down, it will come back around.”

Founders Investment Banking (Founders) is a merger, acquisition & strategic advisory firm serving middle-market companies. Founders’ focus is on oil and gas, industrials, software, internet, digital media and healthcare companies located nationwide, as well as companies based in the Southeast across a variety of industries. Founders’ skilled professionals, proven expertise and process-based solutions help companies access growth capital, make acquisitions, and/or prepare for and execute liquidity events to achieve specific financial goals. In order to assist Founders Investment Banking with securities related transactions certain Principals are registered investment banking agents of M&A Securities Group, Inc., member FINRA/SiPC. M&A Securities Group and Founders are not affiliated entities. For more information, visit www.foundersib.com.