Accounting for Software Development Costs

By: Matt Stanford

Having a firm understanding and consistent application of accounting principles is critical to substantiating operational and financial performance to investors, particularly when subjective judgment is involved. An area of accounting that is persistently subjective and challenging for high-growth SaaS companies is the capitalization of software development costs. In our quarterly tip, we have outlined considerations for when and why SaaS companies may choose to account for software development costs as an operating expense or capital expenditure.

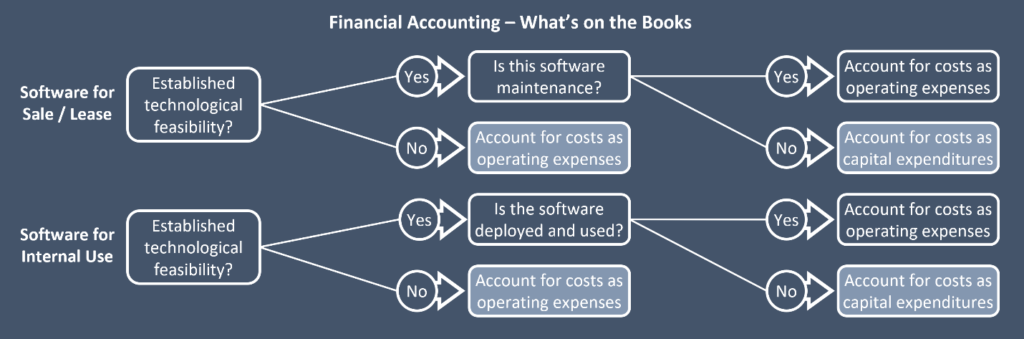

Software development expenses are categorized by what stage of the development process they were incurred. Generally, planning and testing costs necessary to establish that the product can be produced to meet its design specifications or maintenance costs are considered operating expenses. Development costs incurred after technological feasibility has been established and before market release are considered capital expenditures. Any software development costs for improvement beyond the original offering that are incurred after the software is available for sale are capitalized according to the same timeline as an entirely new product, but routine maintenance and alterations costs are considered operating expenses according to GAAP. GAAP-based cost accounting for software development can be particularly cumbersome in agile development environments due to the more rapid change, iteration and feature-by-feature processes; small windows of opportunity for capitalization present themselves during agile development.

Tax Accounting – What You Pay (1)

While financial statements are reported according to GAAP, tax liability is calculated according to various IRS rules. On a high-level, the IRS outlines 2 tax treatments for software development: accounting for all software development costs as current, deductible expenses and accounting for software development costs as capital expenditures to be amortized over 5 years from the date of completion or 3 years from the date the software is placed into service. Software development costs are clarified in detail through IRS Letter Ruling 200236028, CCA 201549024 and Rev. Proc. 2000-50. The default method is generally to deduct costs of Research and Development under Sec. 174 to lower the current tax liability; however, for all tax years following 2021, software development expenses must be capitalized with a 5-year useful life or 15-year useful life for costs outside of the U.S.

Investor View – What It’s Worth

Shareholders and potential investors will primarily examine software development costs as they relate to their expectations of future cash flows and risk; however, the sole change in cash flows that can be manipulated through changes in software development capitalization is a company’s tax liability, which represents small marginal dollar value change. Software development is often capitalized inconsistently, which can overcomplicate financial data analysis and projections for investors. Many investors have different views on the treatment of software development costs. However, when choosing to capitalize software development costs, most investors will prefer that the costs be accounted for consistently and that methodologies be documented thoroughly.

(1) Founders Advisors is not a licensed taxation advisory firm. Any and all taxation information is intended for summary information purposes only.

About Founders

Founders Advisors (Founders) is a merger, acquisition, & strategic advisory firm serving middle-market companies. Founders’ focus is on oil and gas, SaaS/software, industrials, internet, healthcare, digital media and industrial technology companies located nationwide, as well as companies based in the Southeast across a variety of industries. Founders’ skilled professionals, proven expertise and process-based solutions help companies access growth capital, make acquisitions, and/or prepare for and execute liquidity events to achieve specific financial goals. In order to provide securities-related services discussed herein, certain principals of Founders are licensed with M & A Securities Group, Inc. or Founders M&A Advisory, LLC, both members of member FINRA & SiPC. M&A Securities Group and Founders are unaffiliated entities. Founders M&A Advisory is a wholly-owned subsidiary of Founders.