E&P Consolidation Impact on Independent OFS Companies

By: John Sinders

As E&P operators continue to consolidate, the oilfield service industry will be forced to adjust. A similar consolidation story in the industry intuitively makes sense, as E&P operators’ focus on profitability will squeeze service providers and force them to make up the margin with synergies created through M&A.

Integrated independent service providers are the most likely candidates to lead the consolidation wave. These types of companies have come to understand that in order to offer cost-efficient solutions, there needs to be a fundamental shift in operating models to more deeply vertically integrate. By doing so, service companies can offer more value to operators, at a reduced price.

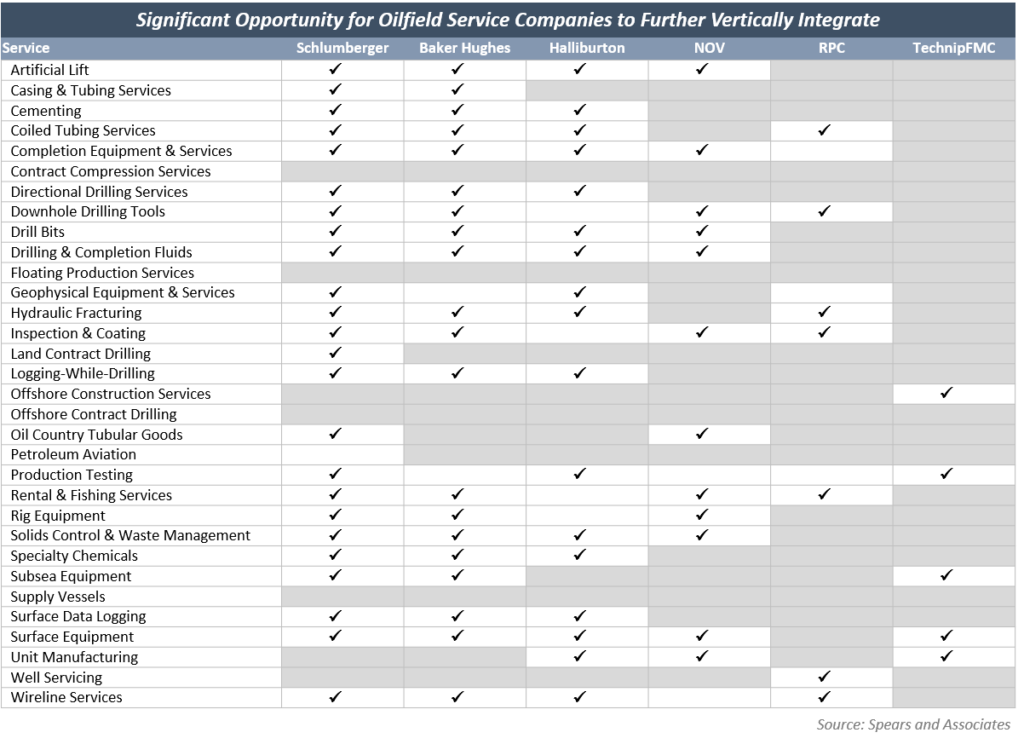

The matrix below depicts six of the larger domestic OFS providers, and their service offerings. While there is a fair amount of overlap, there are noticeable gaps where vertically integrating via M&A may help these providers round out their offerings. Smaller, independent companies with technologies that help enhance the service capabilities of otherwise commoditized offerings are viewed the most attractive candidates; these types of companies can have more reoccurring revenue sources in a market where contracted work is dwindling.

The energy industry is undergoing fundamental changes, which is unlikely to reverse if and when oil prices can sustainably rise. OFS companies have been late to adapt but may be forced to adapt over the next 12 – 24 months as E&P operators continue to consolidate. We believe integrated service providers are best suited to drive this change, and will likely look to vertically integrate with differentiated, technology enabled service offerings.