Strategic Perspective on 2020 M&A Activity

By: Kendrick Vinar

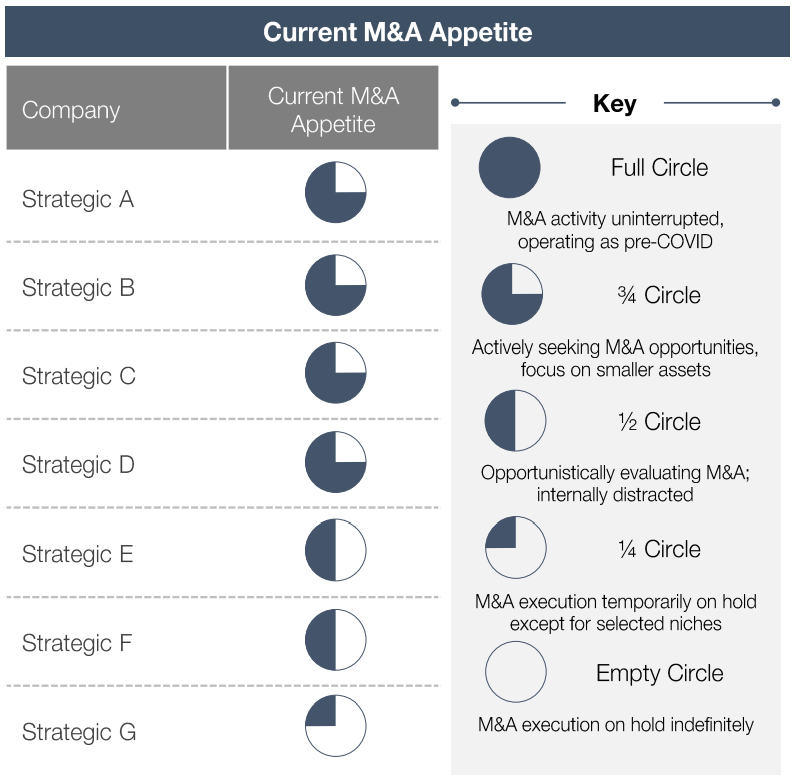

As trusted advisors to our clients, we are committed to providing the most current and up to date information, reflective of evolving market conditions. In early May, we had a number of conversations with strategic relationships in corporate development, M&A, and strategy at large public industrial technology companies to discuss their current priorities and M&A perspective in the midst of this unprecedented COVID-19 outbreak. Groups we spoke with showed a range of perspectives and attitudes toward current M&A opportunities. The most aggressive group explained they were operating “business as usual” with the exclusion of larger opportunities ($250mm+). The most conservative group was in “wait and see” mode; unlikely to move forward in a process except for highly selective.

Key Takeaways:

- Small deals (<$100mm) will rule short-term deal volume while businesses protect balance sheets

- Businesses with operations benefiting from or less affected by COVID are best positioned to be aggressively acquisitive in this time

- Valuing assets in this environment continues to be a question for strategic acquirors; competitive processes will test the limits of willingness to pay

- High quality assets with strong technology are likely to receive significant attention from strategic buyers given the relatively barren M&A market

- Deals will continue to get done in this environment; understanding strategic fit and ability to converse with key decision makers will be key

- Many businesses are seeking opportunistic acquisitions given the market climate