Private Capital Markets Summary – September 2021

Current State of Private Capital Markets:

The private capital markets have stabilized after the initial body blow of the pandemic and shut down of the economy.

Overall, capital markets liquidity remains strong, but there has been a shift in the sources of capital for middle market, private businesses.

- New sources of capital such as family offices, control investors opportunistically seeking attractive investment strategies and opportunistic funds have grown in reach

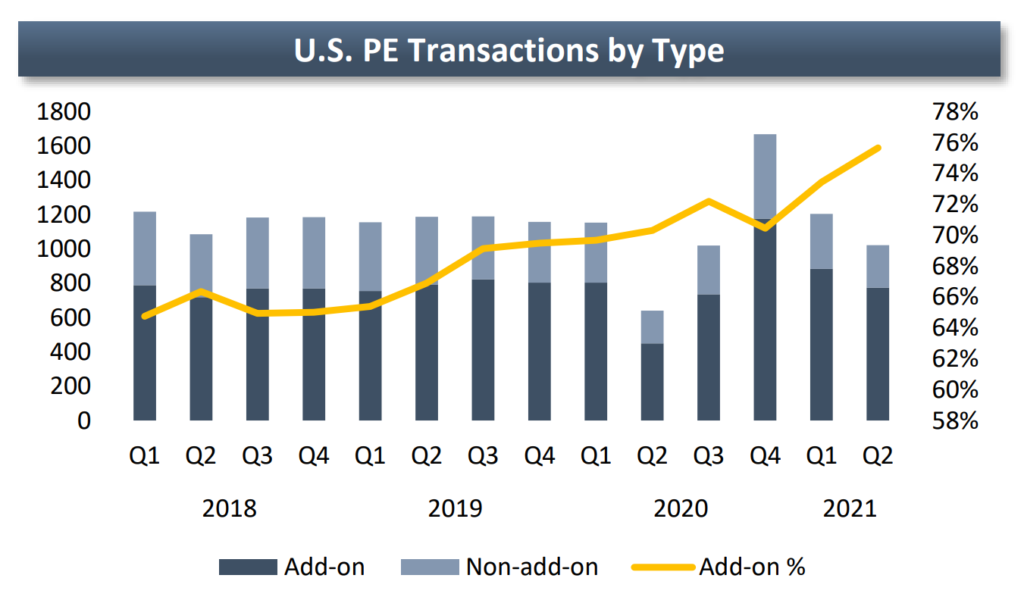

PE dealmaking continued at a frenetic pace in Q2 2021; through the first half of 2021, PE firms have closed on

3,708 deals, nearly two-thirds of their total deal value in 2020.

Debt levels have been steadily returning to pre-Covid levels since late 2020, and today, total debt utilization is largely unchanged from before the pandemic.

- The handful of deviations remaining point to further normalization.

Recent levels of deal flow have given investors increased capacity to dig into more complex credit structures.

- Borrowers are taking advantage of the opportunity to restructure legacy lending relationships.

- Concurrently, add-on deal structures are increasing.

Read the full Market Update here.