Founders Advisors – Middle Market M&A Overview Q3 2021

Observations

Despite the fear due to the COVID-19 Delta variant, the market remains active because of tax law discussions, recovering credit markets, and high levels of buyer dry powder.

- Combined, announced, and recently completed deal counts continue to near record levels.

- As the M&A market continues to persevere, confidence in the overall health of the market will continue to grow.

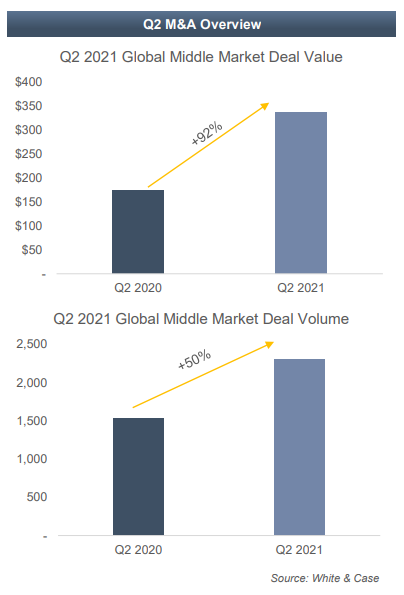

Middle market M&A activity is up substantially year over year in terms of both value and volume.

- We anticipate elevated middle-market PE activity will continue through the remainder of 2021.

Q2 activity points suggests the rest of 2021 will be a robust deal making environment.

- PE funds are seeing an overflowing number of deals forcing them to take diligence in their approach.

- Sellers who were positively affected by the pandemic want to take advantage of high multiples; those who were challenged are realizing the advantages of being part of a larger organization.

The looming promise of a tax rate increase will drive a sense of urgency for sellers to close in 2021.

- Some buyers are offering gross-up payments to cover the difference when tax rates eventually increase, as well as discussing insurance policies to cover potential retroactive rate increases.

- As the year comes to an end, many deals will see a considerable push to close before the start of 2022