Construction Materials – 2021 Year-End Outlook

By: Dennis Coker

Key Trends

Given the strong performance that construction materials companies have experienced over the past six months, most of the key players are revising their outlook for 2H in favor of higher financial targets. Much of this growth is a result of increased residential construction, the rising number of housing starts, and the positive trend in building permits, among other indicators, the large players in the construction materials industry expect a successful finish to the 2021 fiscal year.

While input prices continue to rise and cut into profits within the industry, producers have been largely successful in passing on cost increases through price increases to keep up with inflation. Large players remain hopeful that a continued growth in sales volume will be enough to offset this difference and solidify a record year.

What the Major Players Predict – 2H 2021

“Demand fundamentals remain strong in our rural and exurban markets, while most of the state

– Anne Noonan, CEO of Summit Materials

Departments of Transportation that we serve have returned to typical letting and operating conditions”

Known Increase in Infrastructure Spending

In early August, the Senate passed a massive bipartisan infrastructure bill after months of negotiation. The deal

includes $550 billion in new federal investments in America’s infrastructure over five years, far short of the $2.25

trillion proposal unveiled by the Biden administration in the spring. House progressives are delaying a vote on the

bill until voting to pass a separate $3.5 trillion spending bill focused on the country’s safety net system.

The long-anticipated infrastructure bill, which includes spending across energy, transport, utilities and climate-related initiatives, is expected to provide positive tailwinds for construction materials companies in the United

States. GlobalData, a leading data and analytics company, now forecasts that the US construction industry will

grow by 3.3% annually between 2021 and 2025, vs. its prior forecast of 2.2%. Despite the potential benefits of the

proposed bill, the industry continues to face challenges including rising material costs and labor shortages.

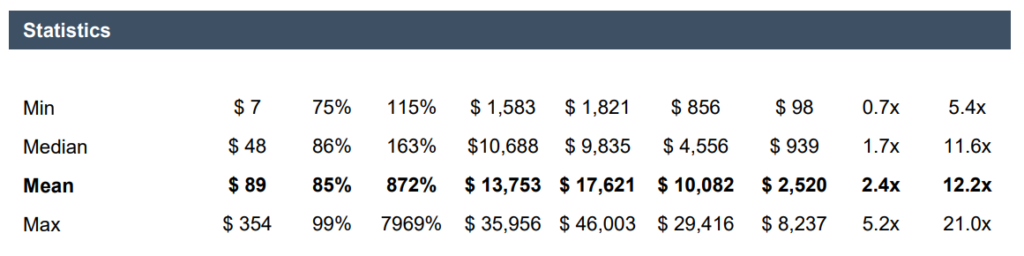

Valuation and Trading Statistics for Major Players