2021 M&A Overview & Outlook

Global M&A continued at a record-setting pace in Q3, fueled by cheap financing, high stock prices and corporate balance sheets flush with cash.

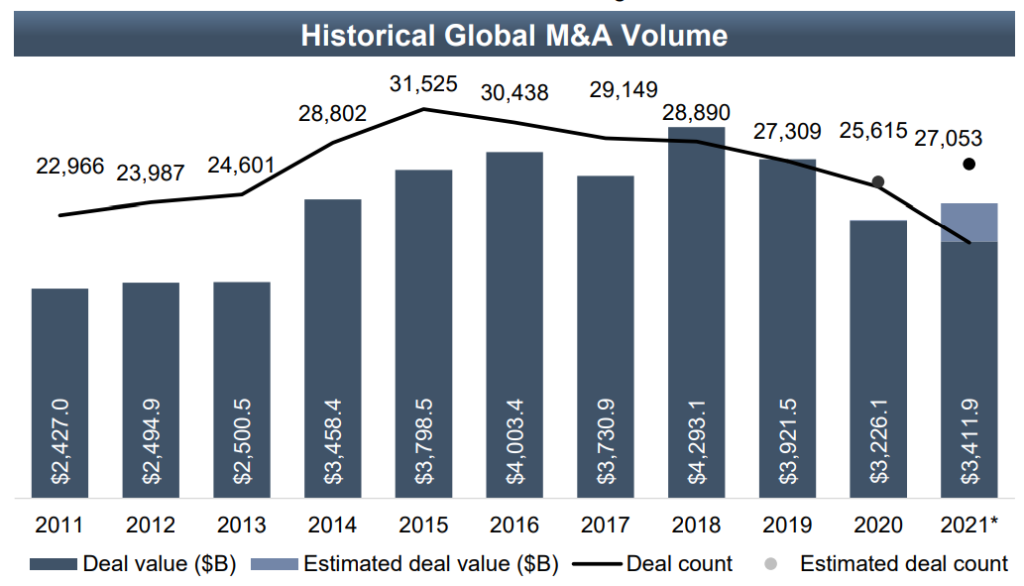

- Through the first three quarters of 2021, over 27,000 deals have been completed for a combined $3.4 trillion.

Accelerating digitization, evolving consumer preferences, supply chain disruptions, and a trend towards vertical integration are major catalysts driving activity across a myriad of B2B sectors.

An expectation for frenzied M&A activity to continue through year-end and into 2022.

- Record levels of private equity dry powder paired with a wave of IPOs have created more potential acquirers that will continue to support M&A.

- Major tailwinds for M&A activity persist, driven by the global economic recovery coming out of the COVID-19 pandemic.

Despite the positive M&A outlook, cautionary headwinds are creeping in, consisting of possible increased government oversight on M&A transactions, China’s lockdowns, labor shortages, supply chain disruptions, and higher energy prices.

Inflationary pressure and future interest rate hikes also present the potential to neutralize currently strong M&A activity. However, corporate and private equity investors remain full steam ahead for the time being.