Private Capital Markets – Newsletter December 2021

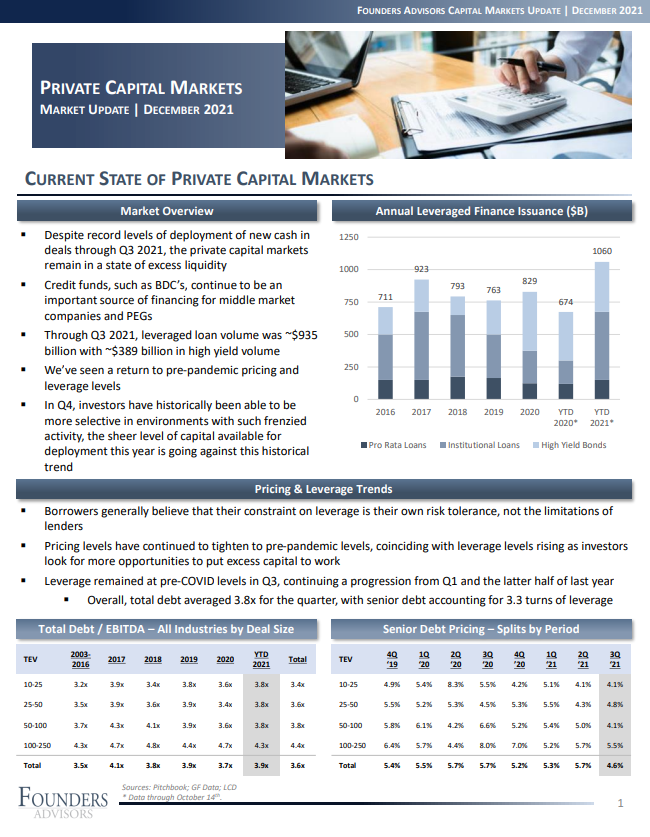

This report summarizes the current state of Private Capital Markets. It covers the market overview, pricing and leverage trends, equity and debt contribution by year, and valuation trends. Despite record levels of deployment of new cash in deals through Q3 2021, the private capital markets remain in a state of excess liquidity.

- Despite record levels of deployment of new cash in deals through Q3 2021, the private capital markets remain in a state of excess liquidity

- Credit funds, such as BDC’s, continue to be an important source of financing for middle market companies and PEGs

- Through Q3 2021, leveraged loan volume was ~$935 billion with ~$389 billion in high yield volume

- We’ve seen a return to pre-pandemic pricing and leverage levels

- In Q4, investors have historically been able to be more selective in environments with such frenzied activity, the sheer level of capital available for deployment this year is going against this historical trend

Please contact us if you would like to learn additional insights about current market conditions and their impact on transactions or approaches to best prepare for a strategic initiative in the future.