Human Capital Management Market Insights

M&A Year In Review

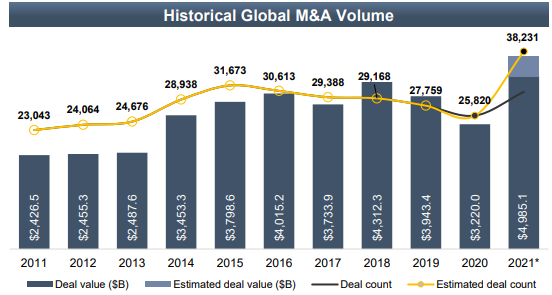

M&A actively flourished in 2021, far surpassing historical records. Activity was primarily driven by private capital markets continuing to deploy cash while remaining in a state of excess liquidity, corporate balance sheets flush with cash and low interest rates.

- Globally, for the year 2021, an estimated 38,231 M&A transactions were completed representing over $5.5 trillion of deal value and up nearly 64% from the year prior.

- In North America, an estimated 18,539 M&A transactions were completed for a combined $2.8 trillion, comprising 48.5% of global transaction volume.

- The financial service, healthcare, and technology industries led the way in Global M&A activity in 2021, with over 11,900 transactions complete collectively.

- Overall, total debt averaged 3.8x for the quarter, with senior debt accounting for 3.3 turns of leverage.

- Deals of $500M and below continued to represent nearly 94% of deal volume.

- Private equity fundraising has risen to unprecedented levels and continues to grow with approximately $3.3 trillion of capital committed but not deployed.

Despite a positive M&A outlook, slight caution is emerging over rising inflation and looming interest rate increases that will hike up the cost of capital and reduce financial firms and companies’ buying power.