Maximizing Enterprise Value for Your Software Business

In volatile markets, investors place more emphasis on profitability. In recent conversations with buyers, this is absolutely the case, as companies on a “path to profitability” are finding it much harder to raise capital. Investor appetite for software and SaaS companies remains high, but companies with consistent and growing EBITDA margins receive special attention. It is common for owners to run personal/non-company related revenue or expenses through the business or to expense certain items that would normally be capitalized, and these practices come in handy during tax season. However, as tech focused private equity groups move away from ‘growth at all costs’ and apply an increased focus on business economics and sales and marketing efficiency (even more than ever), these practices can seriously impact a company’s valuation. Our best advice to software and SaaS business owners considering an exit or recapitalization is: a) gain an understanding of what generally accepted addbacks/adjustments are, b) understand how they impact valuation, and c) begin the process of identifying and tracking them within your business.

What are addbacks/adjustments?

Addbacks and adjustments to EBITDA/profitability come in many forms (typical items and examples are shown below) but can generally be described as any item on the income statement that is non-core, one-time, or personal in nature. Put simply, addbacks and adjustments are items that should be “added back” to net income and/or zeroed out on the income statement due to one of the previously mentioned reasons. A good rule-of-thumb is to imagine that your business was acquired by a publicly traded corporation or private equity group – any item the acquirer a) would not expect to be part of the business going forward, or b) would not include on the income statement is likely an adjustment.

What should I do about addbacks/adjustments?

If you plan to pursue an exit or recapitalization, you should identify any potential addbacks or adjustments to your financial statements and begin tracking them regularly. This can be done however is easiest/most efficient for you and your

team, but we recommend the following:

- Record addbacks on a monthly basis. When looking back quarterly or annually to identify addbacks, it is easy to forget

when/where these items appear on the income statement, and you might forget about others entirely. You reduce the risk

of leaving out some items (leaving additional value on the table) by recording addbacks each month. - Record the exact dollar amount, and which account it affects – This is particularly true if only a portion of an account is

added back. For example, if $20,000 out of a $30,000 “Travel and Entertainment” (T&E) expense was for your family’s

vacations, that $20,000 could be added back to EBITDA; however, it may be helpful for buyers to know where that

$20,000 was originally recorded. By doing so, they can see that the T&E line was artificially inflated. - Keep notes. If you find yourself in a discussion over whether certain addbacks are reasonable, it will be beneficial to keep

careful notes on why you chose to add back the expense. For example, if you add back “marketing expenses” of $50,000, a

buyer may question this choice since marketing expenses are considered normal business practices. However, if you can

explain that these expenses were related to a marketing campaign for a trial product that was discontinued (and

therefore, will not be incurred again next year), the buyer is more likely to agree with your rationale.

How do addbacks affect valuation?

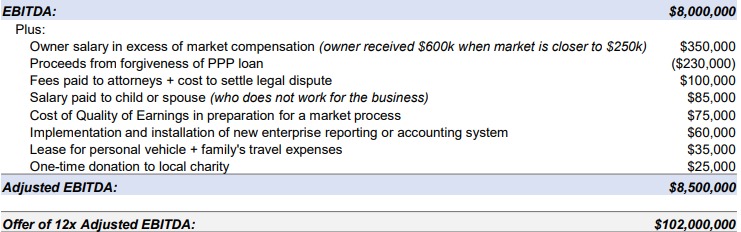

The primary way addbacks and adjustments affect valuation is when they alter EBITDA. Hypothetically, if you receive an offer for your software company based on a multiple of 12 times trailing twelve months (TTM) EBITDA and your company’s unadjusted EBITDA is $8.0 million, the buyer has essentially valued your company at $96 million. Now assume that your company has tracked addbacks & adjustments for the past 12 months:

Some of these expenses may seem immaterial on their own, but if combined, they increase your EBITDA by $500,000. At a 12x multiple, this translates to a $6.0 million bump in your total valuation.

While all of the examples mentioned above may rationally be considered adjustments or addbacks, it is important to keep in mind that once valuation discussions begin, buyers may disagree with certain adjustments or even make adjustments of their own. Addbacks and adjustments are often evaluated on a case-by-case basis, making it important to carefully track and provide explanations for each item. This is an area where an experienced and reputable M&A advisor can provide tremendous value. An M&A advisor’s experience allows them to not only have the advantage of seeing what are customary and non-customary addbacks and/or adjustments, but also the knowledge and experience to appropriately defend the position of the seller or buyer with data and financial analysis.