Current State of Private Capital Markets

In Q3 of 2022, macroeconomic uncertainties continued to constrain capital markets and deal activity. See our analysis of current trends and our expectations for Q4 below:

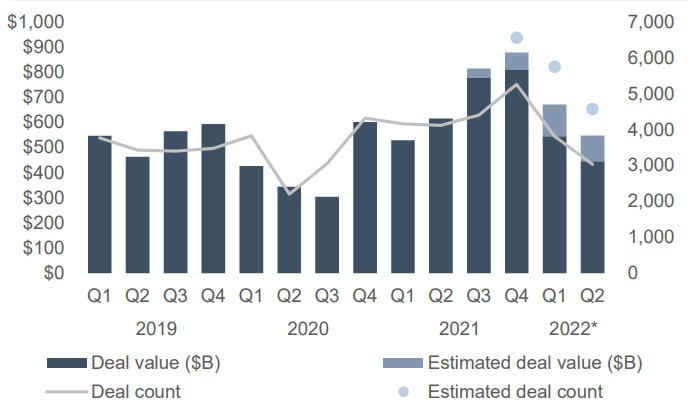

North America M&A Deal Volume

- Macroeconomic headwinds in the first and second quarters of 2022 have caused M&A activity to decline following heightened activity in the back half of 2021

- 1H 2022 saw a 20.8% and 15.0% decline in deal count and value, respectively, relative to 1H 2021

- Despite the market backdrop, deals are still getting done as both strategics and financial buyers look to deploy capital

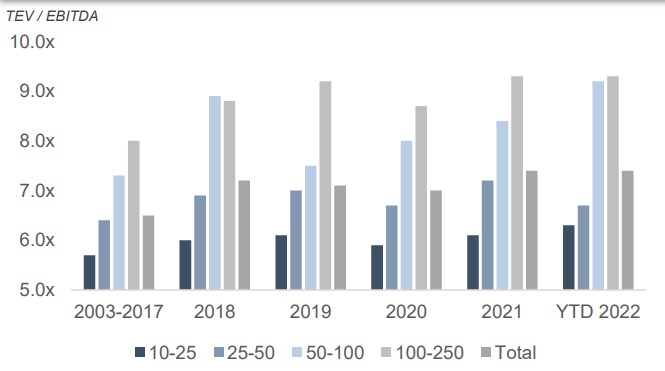

Valuation Trends

- Despite deal volume being down substantially in the first half of 2022, overall valuations have held strong at an average of 7.4x

- However, there is a bifurcation in the market between well established companies serving niche markets and lesser established businesses the former are still commanding strong multiples, whereas the latter are commanding lower valuations or not transacting at all

- As interest rates continue to increase and debt contributions diminish, we expect pressure on valuation levels to emerge

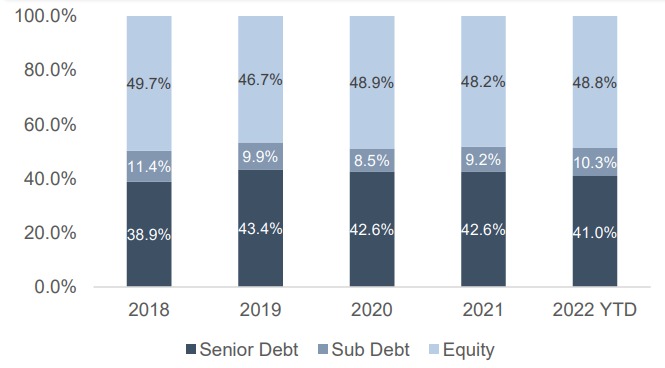

Equity and Debt Contribution By Year

- Minimum equity contribution levels have remained relatively consistent since 2017, with base levels inclusive of rollover at ~50%

- New cash equity contributions remain in the 30-35% range

- YTD 2022 average equity contributions for platform deals dropped slightly to 54% vs. 54.5% for full year 2021

- Overall leverage has come down modestly, with total debt averaging 3.9x for 1H 2022 vs. 4.0x for full year 2021