Key Takeaways & Transaction Trends in Construction Materials Sector

Year-End Overview

Despite macroeconomic challenges, many companies have seen positive financial results so far throughout 2022. There has continued to be a steady pace of M&A activity within the construction materials universe. Companies have doubled down on their strategic plans, with both large acquisitions and sizable divestitures.

How the Majors Navigated 2022

Construction materials companies saw strong pricing momentum in the first half of the year, underpinned by strong demand dynamics, which in many cases, helped to mitigate rising costs stemming from inflation, supply chain disruptions, and labor market shortages. Companies benefited from increased construction spending and tailwinds stemming from the Infrastructure Investment and Jobs Act (IIJA), paired with many state-specific infrastructure spending packages. M&A activity continued at a steady pace, despite the macroeconomic challenges, as companies continued to focus on execution of their strategic initiatives.

Predictions for 2023

Overall, the outlook for the remainder of 2022 appears favorable for construction materials companies. Although rising input costs, supply chain headwinds and labor shortages remain issues for all producers. The passage of the IIJA has increased line of sight to continued construction materials demand, with over $80 billion of the $1.2 trillion package already allocated to states for roads and highways, bridges, ports, airports and water systems. Increases to interest rates in the back half of 2022 paired with rising inflation has introduced some uncertainty around cost of capital for construction projects and its possible impact to M&A activity. However, as many construction materials producers focused on right-sizing their portfolios and spinning off non-core assets in 1H 2022, they are looking for opportunities to redeploy that capital. Based on early 2022 activity, we expect to see strong M&A activity through the end of the year.

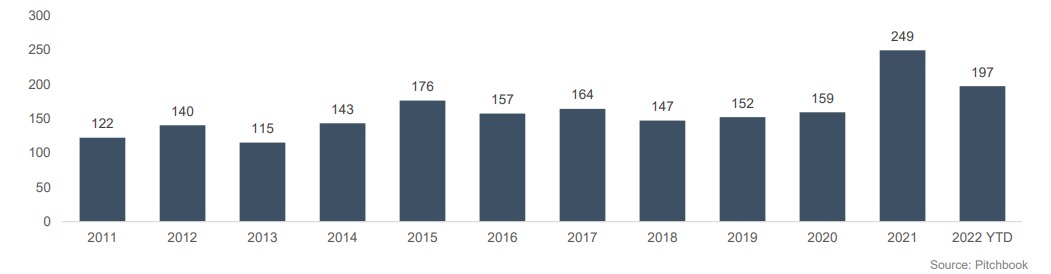

Historical Transaction Trends

2022 has been an interesting year for M&A activity, thus far. We’ve seen the large public companies continue to execute on portfolio optimization with sizable divestitures including CRH’s Building Envelope business segment ($3.8 billion), Arcosa’s storage tank segment ($275 million), and Holcim’s India operations, to name just a few. Companies have doubled down on executing their strategic plans with notable acquisitions such as CRH’s $1.9 billion acquisition of Barrette Outdoor Living and Holcim’s roofing focus with acquisitions of Malarkey Roofing Products and SES Foam in the United States. We have also seen market specific strategies executed by some of the majors, not a “one-size fits all” model. Martin moving away from vertical integration in certain markets (i.e. Martin’s select western US asset divestitures), and Summit spinoffs of downstream operations in some markets, while these same companies remained vertically aligned in other markets.

If you or someone you know has questions, please feel free to reach out to Dennis Coker, Managing Director on our Industrials Team covering the construction materials industry.