The Current State of the M&A Market

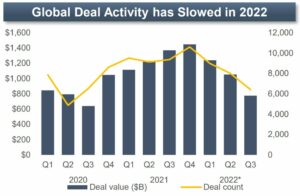

While strong by historical standards, the M&A market has slowed significantly from a record pace last year. Below are outlined the key factors causing this decrease in M&A activity over the past year.

Market Anticipation of a Recession

- The tenor of the market has become defensive as the economy slows

- If the economy is, in fact, heading into a recession, the depth and length is an open question

Federal Reserve Raising Interest Rates to Curb Inflation

- The US Federal Reserve continues to aggressively move to curb inflation

- The benchmark fed funds rate sits at 4.25% – 4.50%, a 15 year high, with rates expected to top 5% by mid-2023

- While core inflation has slowed modestly, it has broadened into more persistent areas that will require a further slowdown in economic growth

Heightened Investment Scrutiny

- Market conditions are prompting both strategic and private equity buyers to carefully consider which M&A processes they participate in

- Defensibility of market position, recession “resistance” and the impact of a future “normalized” commodity environment are top of mind for buyers

- Close attention paid to quality of adjustments and inflationary impacts to EBITDA

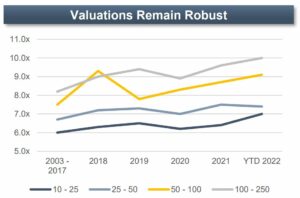

Market Equilibrium – Valuations

- There is approximately $3.3 trillion of dry powder available to deploy by private equity and credit funds

- The demographics of aging baby boomers and owners deciding to sell in the face of the challenges of operating a business in the current economic and geo-political environment have fueled the supply of companies for sale

- So, while deal volume has slowed, valuations remain robust YTD

If you or someone you know has questions about anything discussed, or the general private capital marketplace, please feel free to reach out to Ken Hirsch, Managing Director of Founders’ Capital Solutions Practice.