How the Availability of Leverage Impacts Valuation

By: Michael White

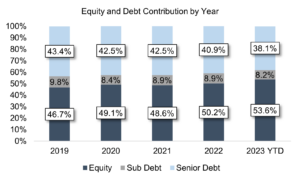

In today’s M&A market, the availability of leverage plays a major factor in determining the valuation of a company. Private equity’s strategy involves leverage accounting for anywhere between 40% and 60% of the deal consideration. Leverage allows private equity to produce higher returns on their investment as they are having to use less equity up front. During 2019 – 2021, we saw debt account for 50% – 55% of deal considerations.

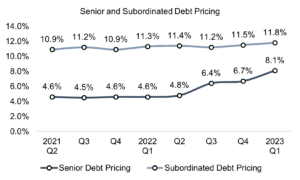

As the economic conditions started to deteriorate beginning in the second half of 2022, the availability of leverage began to get more restrictive. Lenders were increasingly selective, favoring areas of historical experience and more restrictive debt covenants. The result of increased lender scrutiny drove senior and subordinated debt pricing higher in the second half of 2022. This became a major issue and ultimately slowed or halted many deals from Q4 2022 through Q1 2023. This was a particular concern among deals larger than $250 million, where the total leverage commitment was larger.

Due to less availability of leverage, debt was now accounting for approximately 45% of deal considerations involving private equity in the first half of 2023. This is down close to 10% from the leverage sweet spot where private equity typically likes to operate. This has caused them to need to finance deals with more equity than they are accustomed to and has negatively impacted their targeted returns as equity is more “expensive” than debt.

It is undesirable for private equity to finance deals with increased amounts of equity as it results in a lower internal rate of return (IRR) upon exit. This has caused multiples to trend downward slightly on average as buyers are being more selective with their investments. However, for the “right” company, multiples have remained elevated or increased as buyers are competing more fiercely for these companies.

In recent months, this picture seems to have stabilized, partially as a result of clarity from lender investment committees and the establishment of new investment parameters. Private credit markets have begun to reopen and inbound lender inquiries are increasing signaling a desire for new deal flow and pressure to deploy capital.

Investors having increased access to leverage is a positive leading indicator for valuations. Increasing amounts of leverage mean investors will again have access to “cheaper” capital to deploy and this will create increased competition for companies that are looking to sell. This dynamic is fantastic for companies who are running a competitive process. Increased competition between buyers due to the availability of leverage will continue to drive multiples higher, so bidders (both private equity and strategic) can stay competitive in the bidding process.

As we are seeing availability come back into the leverage market, now is a great time to start having initial conversations about the M&A process to take advantage of the increased competition amongst buyers. Please reach out to the Healthcare team at Founders Advisors with any questions you may have about valuations, leverage and what investors are looking for in the current macroeconomic climate.