Due Diligence Management: Tips for Potential Sellers

By: Swede Umbach

Signing a Letter of Intent (“LOI”) represents an exciting milestone in the process of selling a business. After weeks of underwriting, marketing the company, down-selecting bidders, and negotiating the LOI, founders initially feel like the hard part of a process is over. In truth, the most difficult stretch is yet to come. Due diligence is a 45-90 day-long, high-stakes, and in-depth inspection of the business that is unlike anything an owner has faced before. Through our transaction experience, we find that diligence is a formidable challenge for all, but often toughest on the seller. The due diligence process always pushes sellers’ patience and endurance, challenges the management team’s knowledge and organization, and tests any relational equity built between the buyer and seller. While unpleasant, the process is critical for establishing a lasting and fruitful partnership. Our view is that sound strategy and a strong mindset are the keys to due diligence success. How can business owners prepare ahead of time, strategically and mentally, for this process? From a strategic standpoint, we see four factors that increase the probability of success:

Know What’s Coming

Buyers and their third parties will request anywhere from 150 to 300+ items in diligence, spanning multiple areas: financial & accounting, tax, legal, insurance, IT, benefits & retirement, plus other company-specific diligence streams such as technology or contracts diligence. Start gathering these items now so the initial volume does not shock you and impede progress. Founders has completed hundreds of transactions and can share due diligence artifacts beforehand so that you show up prepared.

Control the Element of Speed

Speed is both a business owner’s best weapon and greatest vulnerability. When the seller is slow to fill requests and the buyer is constantly following up asking for updates, the seller loses their ability to negotiate effectively. The buyer can simply punt on key issues saying, “We’re not able to discuss until [key request] is provided.” Conversely, sellers who complete requests quickly have a distinct advantage. Buyers are forced to wrap up diligence quickly, and as a result, keep their third parties focused on the truly important diligence items. This spares everyone the pain and annoyance of follow-up questions on immaterial topics. Moreover, an efficient diligence process creates opportunities for the buyer and seller to focus on important post-close integration discussions, setting up a more favorable post-closing environment.

Focus on the Second Level of Management

Business owners who can thoughtfully bring team members “under the tent” are better positioned for success. Not every seller has the luxury of a high-powered second level of management. But many do, and those who trust those team members to spearhead various diligence streams enjoy a significant advantage. This allows the owner to address immediate needs, such as negotiating deal points or caring for key customers. Additionally, trusting your team to run the process gives those individuals an opportunity to shine in front of their future partner. A successful diligence process can serve as a “job interview” that catapults a strong team member into an equivalent or higher position within a much larger, capital-backed organization.

Discuss Workflow Management Tools with your Advisor

It may seem like a minor point, but the tools your team use matter. Not that any tool or platform is necessarily better; the best tool is the one your team is comfortable with. We see frustration from sellers who operate seamlessly on various tools or software platforms but are frustrated to see buyers consistently send follow ups via some other, more antiquated means. Talk to your advisor and determine which tools are best for your team to tackle and quickly fill a high volume of requests. It is your advisor’s responsibility to either adapt the process to your existing tools or propose a new one that is better suited for the requirements of due diligence.

As noted, the diligence process never fails to push sellers’ patience and test relational equity between the buyer and seller. Mental preparation is key for when the proverbial stuff hits the fan. We advise clients to keep three things in mind:

Fatigue is Inevitable

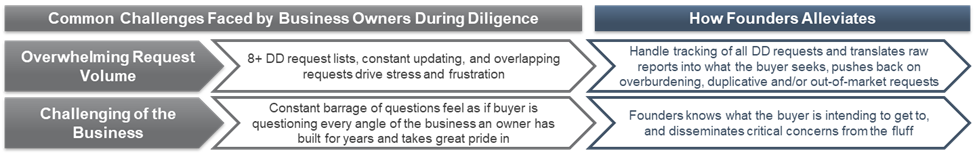

In our transaction experience, sellers always experience some level of diligence-related frustration. The symptoms of deal fatigue include but are not limited to frustration towards third-party diligence providers, second-guessing one’s initial reasons for transacting, resentment towards or loss of trust in one’s future partner, and so on. Again, buyers will request hundreds of items during due diligence; the sheer volume of initial requests often prompts fatigue. Once the initial list is complete, then the follow-ups begin. One founder recently described the follow-ups like so, “It feels like we’re climbing up a mountain made of gravel. It’s two steps forward, one step back.” Simply knowing that these challenges lie ahead can help founders react with wisdom when fatigue inevitably sets in. A good advisor will serve as a project manager, updating the seller on true progress and encouraging them along the way, while simultaneously keeping the buyer in check, pushing back on over-burdensome, duplicative, or out-of-market requests.

Know Your Why

Whatever your reason for transacting – a transition, liquidity & wealth diversification, capitalizing on a growth opportunity, a mix of the three, or something entirely unique – keep it top of mind. You and your advisor should be closely aligned on your motivations for selling, long before due diligence begins. That established framework will be your guide, either sustaining and motivating you when fatigue sets in or giving you the wisdom and confidence to walk away if the terms stray too far from the spirit of the LOI.

Level the Playing Field and Be Confident

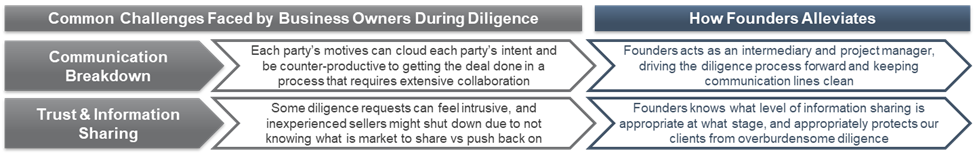

Founders has compared the due diligence process to an engagement before marriage. That comparison still rings true: ‘[The buyer is] like a groom or bride with 100 marriages under their belt. They’ve had good unions and they’ve had bad unions and they are all the wiser for it.’ In this analogy, the right advisor can serve as somewhat of a pre-marital counselor, mitigating the information asymmetry that is typical between first-time sellers and serial buyers. A good advisor also ensures that diligence goes both ways. Advisors ask the buyer for regular updates on needed financing to close, request preliminary integration plans, and obtain the buyer’s internal projections & timelines for rollover equity and profits interests, all of which are critical for sellers to understand before closing the deal. Like a counselor, Founders will absorb good and bad news, maintaining relational equity between two future partners, and provide the experience to know what is normal in this “engagement” and what is not.

In summary, due diligence is grueling, so business owners contemplating a sale should take clear steps before the process begins. Best practices are to know what is ahead, control the element of speed, prime your second level of management, and have the right tools in place. From a mental standpoint, understand that fatigue is inevitable, know your why, and have confidence knowing you are on a level playing field.