Transaction Readiness

By: Neal England

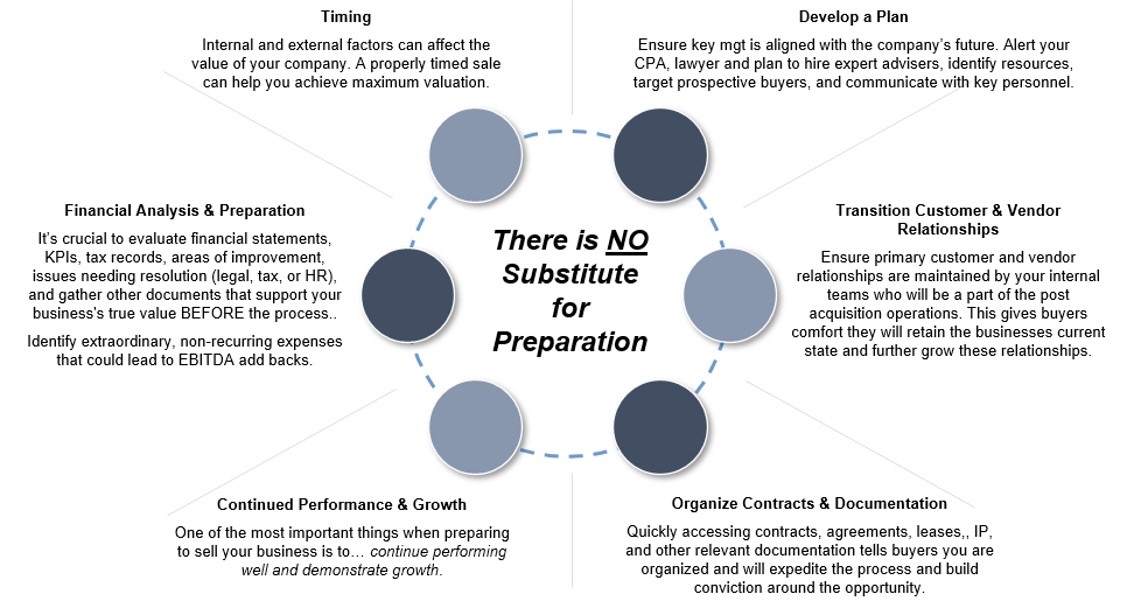

Preparing to sell your company is a complex and emotional process that requires careful planning and execution to achieve a desired outcome. Regardless of the seller’s motivation, there are preparation measures to undertake that will increase the chances of success and maximize enterprise valuation.

Preparation… THEN Execution

Many owners underestimate the importance of front-end process preparation. Proactive preparation can significantly reduce the time needed to get a deal closed, mitigate risks, and improve a seller’s outcome. The following are some key preparation measures to think about:

Financial Statements: Ensure your financial statements are current, clean, and accurate. If possible, eliminate any outstanding debts or legal issues that could distract a buyer. Reduce unnecessary expenses like unproductive teams or excess operational expenses and prepare one year of forward-looking projections, preferably 2-3 years. Identify potential “add-backs” which are typically extraordinary, non-recurring expenses that do not pertain to ongoing business operations and be positioned to defend them in detail. Examples of addbacks can include:

- One-time or non-recurring expenses

- Pro forma events like new hires, new facility opening, or closing

- Accrual versus cash-based accounting

- Owner’s personal expenses

- Potential contract related adjustments

- Accounting for operations that will not continue post-transaction

Operations: Document your systems, functions, and business processes and take a step back to analyze your teams to ensure they are capable and productive. Understand their capacity, desires, and growth potential so you can suggest them for potential roles and gaps with the right buyer. Solid, productive teams are drivers of valuation.

Legal & Cap Table: Make sure your legal structure is in order, that licensing and registrations are current, and that the cap table is “clean.” Buyers don’t want to inherit compliance issues or solve your stakeholder issues, but they may agree to do so at the expense of your enterprise value. And organize all key contracts, agreements, and leases to ensure they are transferable and understand their exit provisions.

Customers & Supplier Contracts: Review and organize customer and supplier contracts to ensure they are current for rates, obligations, key contacts, are fully executed and transferable in a change of control event.

Important Internal Considerations

Closing a deal requires a high level of intensity to equip a buyer and third-party diligence providers with necessary information. There are also internal considerations that sellers should factor into the transaction process. Below are key internal considerations to be aware of in any transaction:

- Employee Notification: Owners must consider when the time is right to inform employees about the transaction. Their help and expertise may be needed with specific diligence streams, as well as how to mitigate any concerns over their immediate and long-term employment post-close.

- Retention & Incentives: It is crucial to reduce go-forward employee concerns about job stability to help gain their continued buy-in during a transaction. Incentives can involve a cash bonus or buyer profit interests and be paid in full by the buyer or shared between buyer and seller. This is case-specific.

- Cap Table Clean Up: Many companies have phantom equity and/or multiple stock classes. Understanding and correctly building a proceeds waterfall can be a challenge for first time sellers, and mistakes realized after the deal closes can be difficult to clean up. Seek accounting help to ensure ultimate accuracy.

- Customer Notification: Buyers often want to speak to key customers pre-close. The timing of any client contact must correlate with the level of diligence and sellers sense of closing certainty. Reviewing and approving talking points or scripts is important to ensure customers are not spooked by the transaction.

- Tax Mitigation Strategies: Trusts, Donor Advised Funds and other tax strategies are increasingly common and need to be addressed pre-close with subject matter experts to ensure they are set up appropriately with the desired tax mitigation results.

Key Take Aways

- Thorough preparation and organized planning is your best friend. It equips you to handle challenges effectively, gives YOU leverage, de-weaponizes buyers/investors, and buys you margin to think carefully and strategically, significantly enhancing the likelihood of success.

- Remain open-minded, opportunistic, and embrace change. You don’t know what you don’t know so be willing to adapt to new ideas and challenges to uncover ways to bridge gaps and achieve mutual success.

- Maintaining credibility is crucial to advancing momentum in your favor. No one gets 100% of what they want, so be willing to compromise. Stay alert and expect the unexpected while seeking ways to mitigate risks.

- Hire proven professionals (experienced advisors, transaction attorneys) who you have good chemistry with and try to view them as investments to help achieve your goals versus an expense.

As with all transactions and negotiations, the devil is in the details and ensuring that you, as the seller, have a strong M&A advisor to help navigate the journey with you is crucial. If a transaction is on the horizon for your company Founders Advisors would welcome the opportunity to share additional insights around our process and how we represent sellers through a successful transaction.