The Power M&A Market: What CEOs Need to Know in 2026

A sell-side perspective on valuations, buyer activity, and where the market is heading

The Market is Undeniably Hot

Let’s start with the obvious: deal activity in the power sector has gone parabolic.

After a two-year hangover from the 2022-2023 rate hike cycle (when corporate buyers pulled back and deal counts dropped nearly 30% from their 2021 peak), the market came roaring back. Electrical contractor M&A volume climbed 13% in 2024, average deal sizes nearly tripled, and by 2025, U.S. power and utilities deal value had exploded to $141.9 billion, up from roughly $28 billion the year prior.

Yes, some of that headline number is driven by mega-deals: Constellation/Calpine ($29B), NRG/LS Power ($12.5B). But look past the megacaps and the story is the same. PE firms closed more electrical construction deals in the first half of 2025 alone than they did in all of 2024. The U.S. electrical contracting market (a $255 billion industry growing toward $295 billion by 2030) has become one of the most sought-after sectors in the entire PE landscape.

The tailwinds are durable: an aging grid requiring comprehensive modernization, AI-driven power demand rewriting utility load forecasts, and a generational shortage of skilled tradespeople that makes acquiring a workforce more efficient than building one. The consolidation wave is not cresting. It is still building.

Valuations Are at Historic Highs

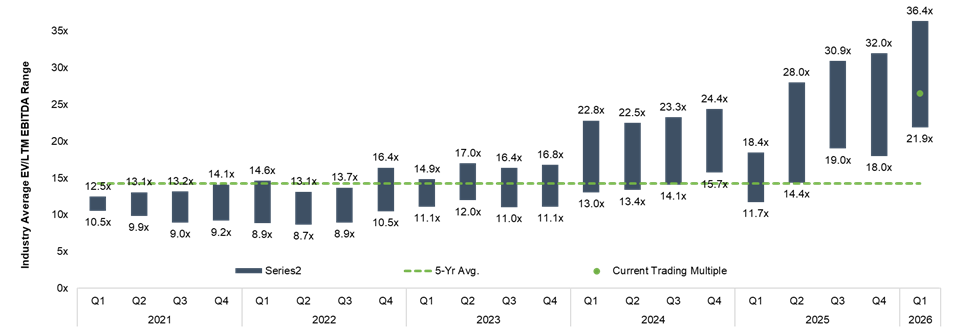

Public power services and electrical infrastructure companies are trading at a significant premium to their 5-year historical EV/EBITDA averages. Quanta, Comfort Systems, MYR Group, MasTec, EMCOR, IES Holdings, Primoris, Dycom, and Vertiv (the peer group that institutional buyers anchor private market deals to) have all re-rated substantially since 2022.

The chart below illustrates the peer group’s annual average EV/EBITDA multiple from 2020 through 2025, compared to the 5-year historical average of 14.2x. The current trading multiple of 19.6x represents a 38% premium to that historical benchmark.

When buyers underwrite private market deals, these are the benchmarks they start from. That premium is bleeding through to private transactions, and for owners of sub-$250M businesses, it is creating a window that does not come around often.

New Money Is Flooding the Space

The most important shift in the power services M&A market is not the volume of deals. It is who is doing them.

Traditionally, this was infrastructure fund territory: Brookfield, Macquarie, GIP writing large checks for regulated utilities and long-duration assets. That has changed. Today, traditional B2B-focused PE firms are competing aggressively for power services platforms, and the names are impossible to ignore. TPG paid an estimated ~$5 billion for Pike Corporation. Blackstone wrote a $1.6 billion check for Shermco. Apollo moved on both The State Group and PowerGrid Services in the span of six months.

It is not just the megafunds. Mid-market firms are just as active, and arguably more relevant to the lower middle market. Kohlberg acquired both RESA Power and Loenbro within the same year. Searchlight Capital has built Integrated Power Services into a national platform through 26 acquisitions. Each of these firms came to the space with a different thesis, a different target profile, and a different vision for where power services is headed.

The upstream deals are having a downstream effect. When Shermco trades at $1.6 billion and RESA quadruples in value in three years, it sends a clear signal to the broader market: scaling a power services business will be rewarded. We are already seeing that confidence translate. Platte River Equity’s acquisition of United Utility Services is a direct example of lower-middle market and middle market capital chasing that same thesis. These are not isolated data points. They are early proof of concept for a wave of platform-building that, in our view, is still in its early innings.

The Theme to Watch in 2026: Bring Your Own Power

Power demand is growing at a pace the grid was not built to handle, and everyone in the industry knows it. At PowerGen and DistribuTech this year, one conversation kept coming up: how do you actually secure power for a data center when every traditional path is blocked? Nuclear is a decade away. GE Vernova’s gas turbine backlog stretches into 2029. Grid interconnection queues in key markets exceed eight years. In January, Trump made the political stakes explicit, directing data center operators to fund their own power rather than pass costs to consumers.

The market is starting to respond. Kodiak Gas Services’ $675M acquisition of Distributed Power Solutions is a clean expression of where capital is going: 384 MW of distributed generation already serving data centers at 99.9% reliability, no grid queue, no decade-long backlog. Fast, behind-the-meter, and already working. It will not be the last deal of its kind.

2026: The Window Is Open

Every indicator points the same direction. Deal activity is accelerating, valuations remain at historic highs, and the buyer pool has never been deeper or more competitive. The secular tailwinds (grid modernization, AI-driven power demand, the BYOP buildout) are not a 2026 story. They are a decade-long story, and we are in the early chapters.

Founders will be at PowerTest in Nashville at the beginning of March and would love to connect. Please reach out to Evan Klisares if you’re planning to attend.

Data sources: PwC, Capital IQ, PitchBook, BMI Mergers, public company filings. Chart data reflects peer group annual average EV/EBITDA multiples for Quanta Services, EMCOR Group, MasTec, MYR Group, Comfort Systems USA, IES Holdings, Primoris Services, Dycom Industries, and Vertiv.