Multi-Unit Market Update – Q3 2021

By: Mike McCraw and Nathan Kelly

Multi-Unit Community Buzz: Buyer Interest Persists Despite Delta Concerns

“The pandemic has accelerated consumer behavior meaningfully. We have incremental disposable income because people aren’t traveling, so they’re spending it more on these consumer experiences.”

– Venky Ganesan, Partner at Menlo Ventures

“The M&A momentum points to a fundamentally strong market looking ahead. This pace of dealmaking could continue for the next 18-24 months, with new financing solutions and sectors driving activity.”

– Andrea Guerzoni, Global Vice Chair at Ernst & Young

“It may take longer than some firms anticipate to find qualified workers (especially with unemployment so lucrative). But we do think the logjam is temporary as firms and workers find each other again.”

– Nela Richardson, Chief Economist at ADP

Consumer Multi-Unit: Key Indicators & Takeaways

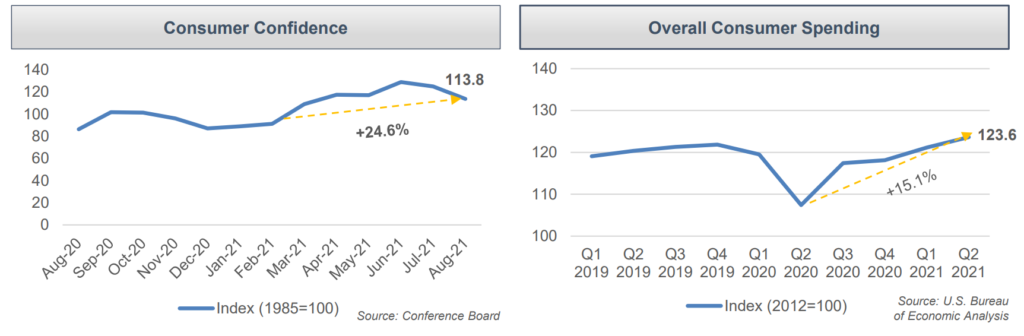

Multi-Unit Companies look to seize upon increased consumer spending as pandemic restrictions loosen.

- Although consumer confidence has slipped moderately

recently, growth since the beginning of the year has been

considerable. - Confidence slipped modestly from June’s reading of 128.9,

the highest level since February 2020.

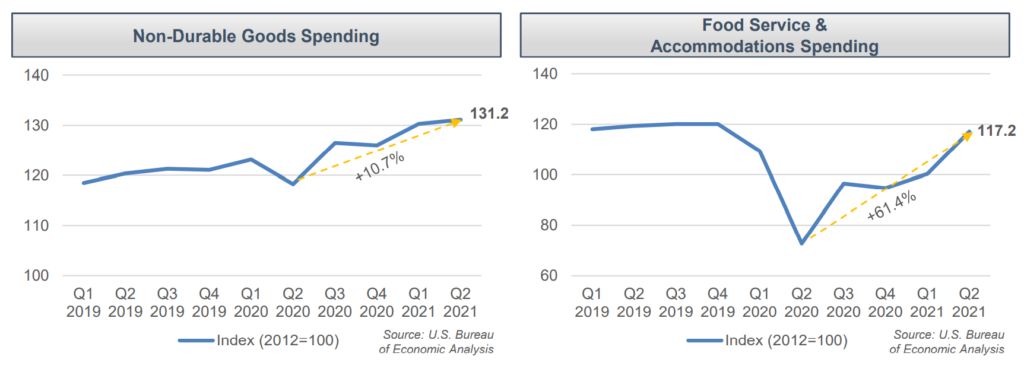

- Consumer spending continued its rebound in Q2, boosted by

government stimulus payments and the rising number of

COVID-19 vaccinations.

- The increase in non-durable goods spending in Q2 has been

driven by food services and accommodations. - We’re seeing a pivot from consumption tilted towards goods

– many of which can be delivered – to in-person services

such as travel, dining and entertainment.

- As the pivot from goods consumption into services is

happening, we’re seeing surge pricing in everything from

airfares to hotel rooms, with more consumers going out to

eat than in the past.

Middle Market M&A Overview

Observations

Despite the fear due to the COVID-19 Delta variant, the

market remains active because of tax law discussions,

recovering credit markets, and high levels of buyer dry

powder.

- Combined, announced, and recently completed deal

counts continue to near record levels. - As the M&A market continues to persevere,

confidence in the overall health of the market will

continue to grow.

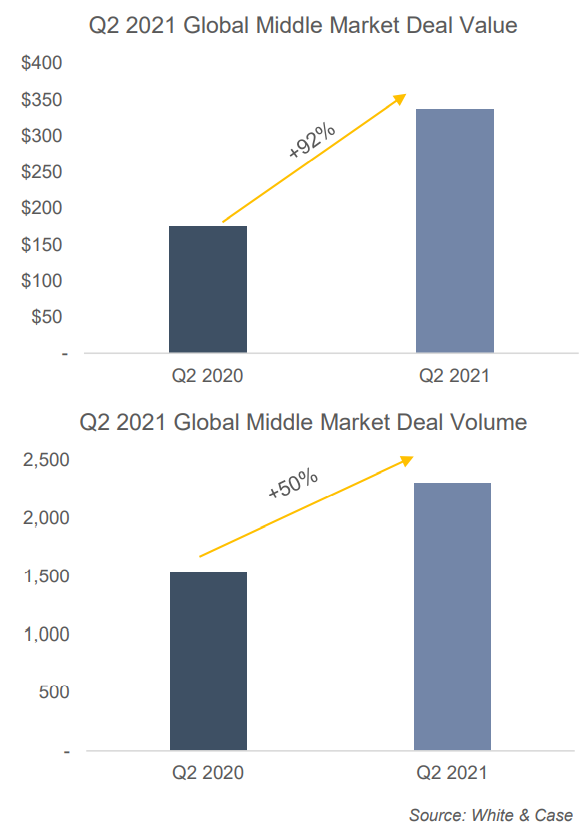

Middle market M&A activity is up substantially year over year

in terms of both value and volume.

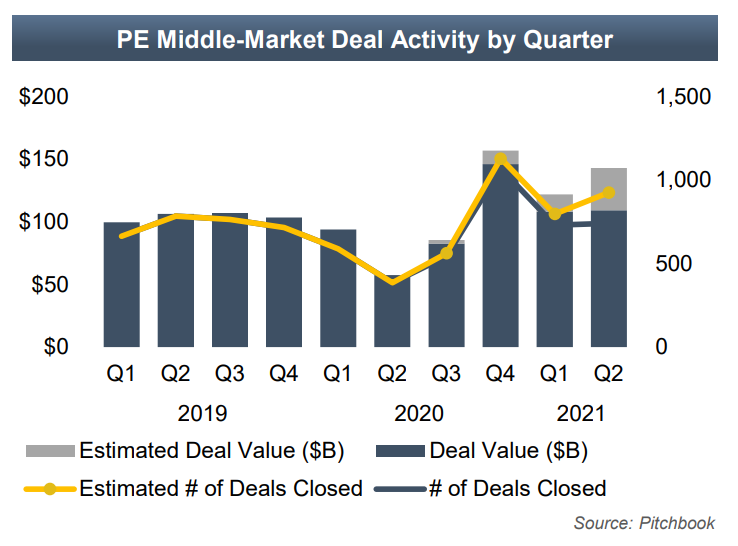

- We anticipate elevated middle-market PE activity

will continue through the remainder of 2021.

Q2 activity points suggests the rest of 2021 will be a robust

deal making environment.

The looming promise of a tax rate increase will drive a sense

of urgency for sellers to close in 2021.

- Some buyers are offering gross-up payments to

cover the difference when tax rates eventually

increase, as well as discussing insurance policies to

cover potential retroactive rate increases - As the year comes to an end, many deals will see a

considerable push to close before the start of 2022.

- PE funds are seeing an overflowing number of deals

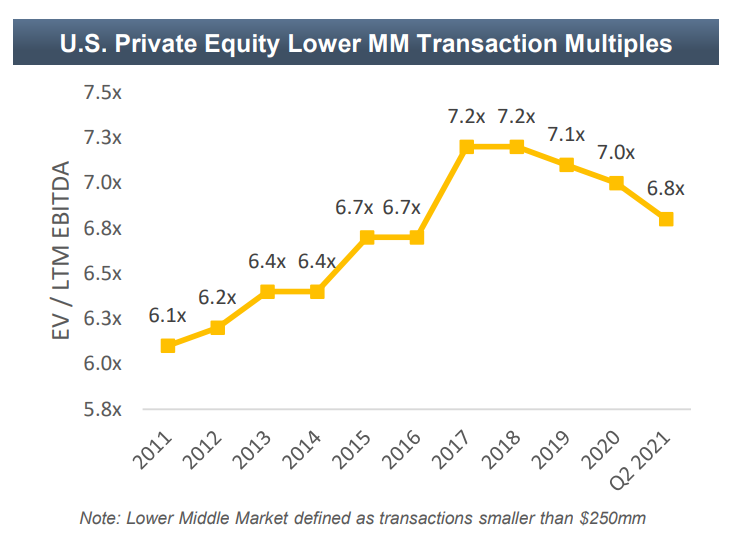

forcing them to take diligence in their approach. - Sellers who were positively affected by the

pandemic want to take advantage of high multiples;

those who were challenged are realizing the

advantages of being part of a larger organization.

Q2 M&A Overview