Is Your SaaS Company Investment Grade?

By: Billy Pritchard

Unlike owners of many traditional businesses in manufacturing or service industries, SaaS entrepreneurs typically set out on a journey of building their businesses with the end in mind → a noteworthy exit /liquidity event. The Technology Practice at Founders Advisors spends most of our time engaging with founders of vertical & horizontal SaaS companies, helping them execute on market processes to achieve their ultimate end goal. But, along the journey of building a great SaaS company, it can be difficult for founders to truly judge if they are executing on the right path towards building an “Investment Grade” company. Rather than focusing on building long-term Enterprise Value in a business, SaaS founders are often pulled towards making decisions to yield near-term results. Additionally, as we first begin engaging with a SaaS company to pursue a liquidity event, we sometimes find issues that will negatively impact the valuation for that business. And at that point, founders are often too far along in their company’s journey to materially address those issues.

So…How should a founder truly assess whether the decisions they are making are continuing to drive them towards an “Investment Grade” SaaS company?

To offer a bit of insight, our team has outlined a few key areas, benchmarks, and avoidable pitfalls for SaaS entrepreneurs to keep in mind as they work towards building their company. These insights & learnings (discussed in detail below) come directly from our recent sell-side process experiences, including processes targeted towards both private equity and strategic buyers. While this is not a comprehensive roadmap for a SaaS founder, we believe these areas are critical to be aware of as a founder navigates growing the business with an exit in mind.

Additionally, due to a high volume of similar conversations with SaaS founders, our team at Founders Advisors has formally developed an online “Investment Grade” assessment tool focused on the SaaS space. We would encourage founders to take this assessment on a regular basis (semi-annually or annually) to receive actionable insight and benchmarking data to help improve their business along the journey to an ultimate exit.

To complete our SaaS-focused Investment Grade Assessment, please follow the link here: FOUNDERS ADVISORS INVESTMENT GRADE ASSESSMENT

Key Areas of Focus for Building an Investment Grade SaaS Company

Growth v. Profit – Find the Right Balance

While they all acknowledge that it is somewhat rudimentary, most buyers examine SaaS companies based on the “Rule of 40” – that is, ARR Growth Rate + EBITDA Margin should be greater than 40. The strongest companies are often scoring greater than 80. Therefore, as owners weigh their current options to fund growth or focus on achieving a profitability hurdle, they can determine how to effectively budget growth-driving expenses like sales and marketing, development, conference sponsorship/participation, etc. against the anticipated impact to their bottom line.

Ultimately, having a proven growth model is the key for investors and drives valuation upward. Sophisticated investors recognize that some companies may have had to choose profitability over spending for continued growth, but their capital can assist by efficiently increasing sales and marketing expenses in channels that historically have yielded fruit. In understanding the growth model, they’ll key in on unit economics – if you can point to past trends around successful sales and marketing campaigns, they’ll be excited to pour fuel on that fire.

Track & Understand Your “Key Performance Indicators”

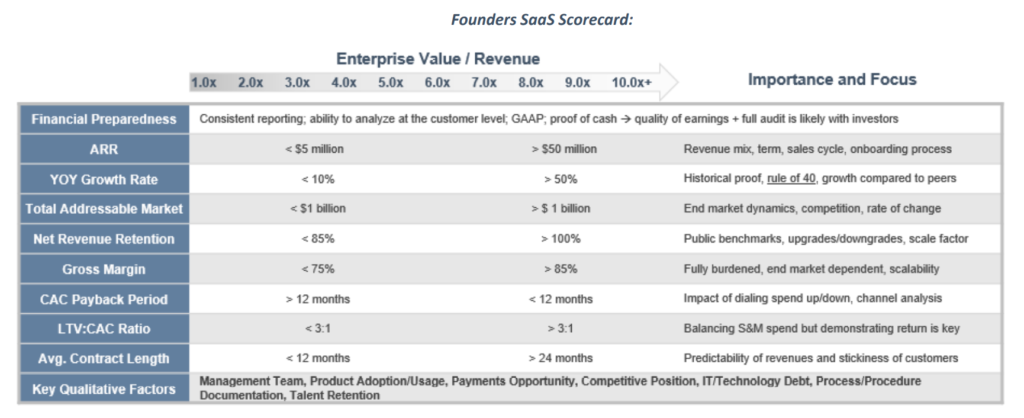

On the following page is a “SaaS Scorecard” that our team has developed over the years. Are you able to grade yourself on each of these metrics and consistently produce the data to support those calculations? Buyers will dive deep into each of these areas as they understand the key drivers of a SaaS business. Premium valuations are dependent on both the signals these metrics show and the quality of data produced by the company to support these calculations.

Know Your Customer Base & Build Net Promoters®

When diving into a SaaS company’s customer base, there are a few key areas for a founder to have strong data-driven insight:

- What Are The Demographics Of Your Customer Base? While this may seem simple, founders should be able to readily produce a complete customer census with details on the customer’s industry / vertical, estimated revenue size, employee count, geographic location, first billing date, etc. By reviewing this level of data, buyers can understand key enhancers like your Total Addressable Market, the mission-critical nature of the product, and (if the buyer is a strategic) potential overlap within their existing customer base.

- How Do Different Cohorts Of Your Customer Base Perform? One area that we think many SaaS founders can improve upon is performing detailed cohort analysis of their customers. While retention metrics of the entire base are important, understanding those same metrics at a more granular level can help a buyer build its investment case. Reviewing your customer base by segments such as Plan Size, Vintage, or Industry Vertical can provide valuable insights on where to focus your operational efforts moving forward.

- Are Your Customers Net Promoters®? We believe a Net Promoter Score® is one of the best indicators of a company’s future growth potential. The tool provides scaled results to one simple question: How likely are you (scale of 1 to 10) to recommend this company to a friend or colleague? Tracking, investing in, and maintaining a healthy NPS score enhances your customer satisfaction & retention metrics, and it gives you a “free salesforce” of enthusiastic fans to refer your company to others.

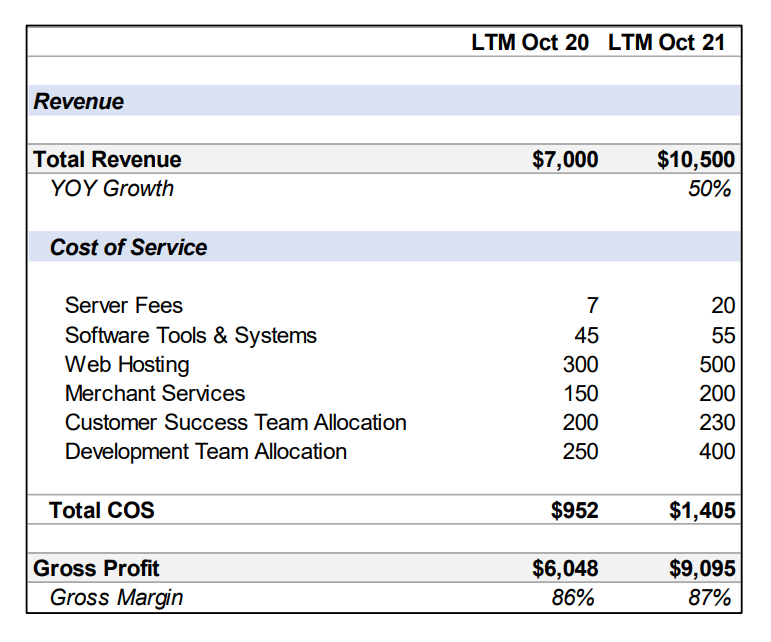

Focus on Gross Margin & the Ability to Scale

- A SaaS company’s Gross Margin is a strong driver of its enterprise value, and it has become a defining metric in assessing the company’s ability to scale. However, many founders are not properly tracking Gross Margins, as they are not fully allocating expenses to their Cost of Delivery / Service. While we often see hosting fees and merchant service fees allocated to Cost of Delivery / Service, many founders are ignoring other necessary costs, including people, that are required to continue to service their existing customers. On the following page is an example of a fully burdened gross margin calculation for a SaaS business.

- From a buyer’s perspective, the key to this metric is whether the business can continue to support rapid growth over time and provide a significant return on Sales & Marketing spend. With our engagements, we tend to focus on a benchmark Gross Margin of >80% as an indicator that the business can continue to achieve strong growth rates.

Example SaaS Gross Margin Calculation

Keep Your Legal House in Order

We understand the different priorities that founders must juggle as they manage a fast-growing SaaS business. Go-To-Market strategy changes, customer success team building, and product roadmap development will certainly take precedence over spending time addressing gaps in your legal documentation. However, of the issues that we see derail strong deal processes, issues found in the legal diligence are often the most critical. While there are a multitude of potential pitfalls on the legal side, below are common areas that can create issues but are preventable on the front end:

- Who Owns Your IP? Make sure your employees (and independent contractors) are executing clear IP Assignment Agreements at the start of their employment. Waiting until the closing table to ask for signed documentation can be challenging and sometimes expensive.

- Do You Have Clearly Written Customer Contracts? Customer agreements should be written with a future sale or exit in mind to avoid assignability or other IP ownership issues. Poorly written agreements can cause closing delays at a minimum.

- Are You Fully Tax Compliant? Sales & Use Tax seems to be a common issue on many SaaS deals. Make sure you are working with an experienced software tax advisor to collect & pay Sales & Use tax in all the appropriate jurisdictions.

SaaS founders should begin their journeys with a strong legal advisor, and they should plan regular reviews of their legal documentation to make sure these major legal issues do not become a reality for their company.

Please reach out to our team at any point for more detailed conversations about how you can build an Investment Grade SaaS Company.