Classes of Equity & Impacts to Future M&A Proceeds

By: Billy Pritchard

Preferred vs. Common

When assessing one or multiple Term Sheets or Letters of Intent involving a private equity recapitalization, founders often need guidance on a critical piece to the deal structure: the classification of stock that the PE investor will hold post-closing.

For private capital transactions in the lower middle market, we often see three different classifications of stock / equity: Common Equity, Participating Preferred Equity, and Convertible Preferred Equity. Below, we will review the structure of each type of equity, why that type of equity is used in various situations, and the impact of each to shareholder proceeds in a future M&A transaction.

Common Equity or “Pari Passu”

Common Equity, which is often referenced as “Pari Passu” equity, aligns all shareholders on equal footing. All shareholders (both Buyer & Seller post-closing) are treated the same in terms of voting rights and distribution preferences. This is a more favorable structure for Sellers as they are not taking a subordinated position post-closing, and Buyers will often lean into this equity structure as a way of proving that they will be an “aligned partner” with the Seller post-closing.

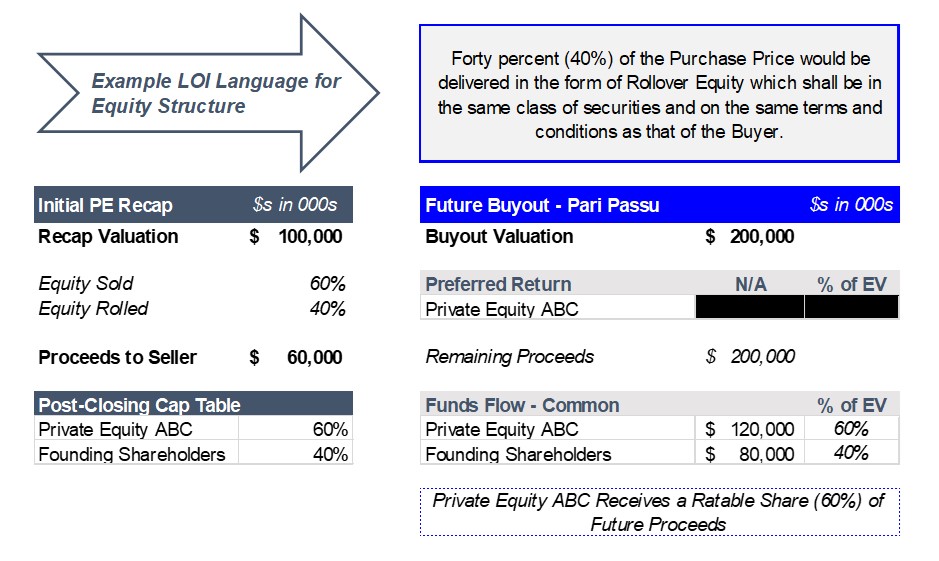

Below is an example of i) an initial PE majority recap using Common Equity, followed by ii) a future 100% buyout by a strategic buyer. As you can see from the example, Common Equity holders share ratably in the proceeds from the future exit.

Participating Preferred Equity

Of the two classes of Preferred Equity to be discussed, Participating Preferred Equity is the furthest from Common Equity. When thinking Participating Preferred, the word “AND” should come to mind, as the Participating Preferred Equity holder is paid in two ways during a future liquidity event. A holder of Participating Preferred Equity has a set preferred return that is paid prior to any additional distributions, AND the Participating Preferred Equity holder will “participate” ratably, alongside Common Equity holders, in the share of proceeds net of the preferred return payment. The preferred return is often set as either a liquidation preference (e.g., 1.5x Invested Capital) or a compounding annual return of invested capital (e.g., 8.0% Compound Annual Return).

This is certainly a favorable structure for buyers, as it creates downside protection by having the preferred return paid out first and increases overall future proceeds in higher growth scenarios. Buyers typically lean into this structure when working to justify a “premium valuation”, as they are able to derisk the investment and increase the likelihood of higher returns by modeling out more proceeds in a future exit.

Below is an example of i) an initial PE majority recap using Participating Preferred Equity, followed by ii) a future 100% buyout by a strategic buyer. As you can see from the example, the Buyer receives a greater than ratable share of total proceeds in the future exit.

Convertible Preferred Equity

More of a middle-ground approach, Convertible Preferred Equity is a type of preferred stock where the equity holder is paid in an “either / or” manner. The Convertible Preferred Equity holder would receive the greater of i) a preferred return payment, or ii) the amount the equity holder would receive if they converted their equity into Common Equity. Similar to Participating Preferred structures, the preferred return is often set as either a liquidation preference (e.g., 1.5x Invested Capital) or a compounding annual return of invested capital (e.g., 8.0% Compound Annual Return). However, there is a future exit break-point where converting to Common Equity would yield a better outcome for the equity holder. Buyers typically lean into this equity structure in order to derisk the investment, as they can underwrite to the preferred return in limited growth scenarios.

Below are two examples of i) an initial PE majority recap using Convertible Preferred Equity, followed by ii) a future 100% buyout by a strategic buyer. In Example 1, which is a lower growth scenario, the Buyer is paid its Preferred Return and the rest of the proceeds are distributed ratably to the other Common Equity shareholders. In Example 2, a higher growth scenario, the Buyer converts its equity and participates ratably alongside the other Common Equity Shareholders.

In short, all else equal, Common Equity is more favorable to founders in a recapitalization. However, Preferred Equity is a strong tool for a buyer to use to justify a valuation that makes their offer not “all else equal,” and that can make it a compelling piece of deal structure for a selling founder. Overall, founders must understand the impact of these equity classifications in order to fully assess what an offer means to them today, and more importantly what it means to them in the future.