A Look Inside Biden’s Infrastructure Bill – The American Jobs Plan

By John Sinders & John Sullivan

Synopsis of The American Jobs Plan

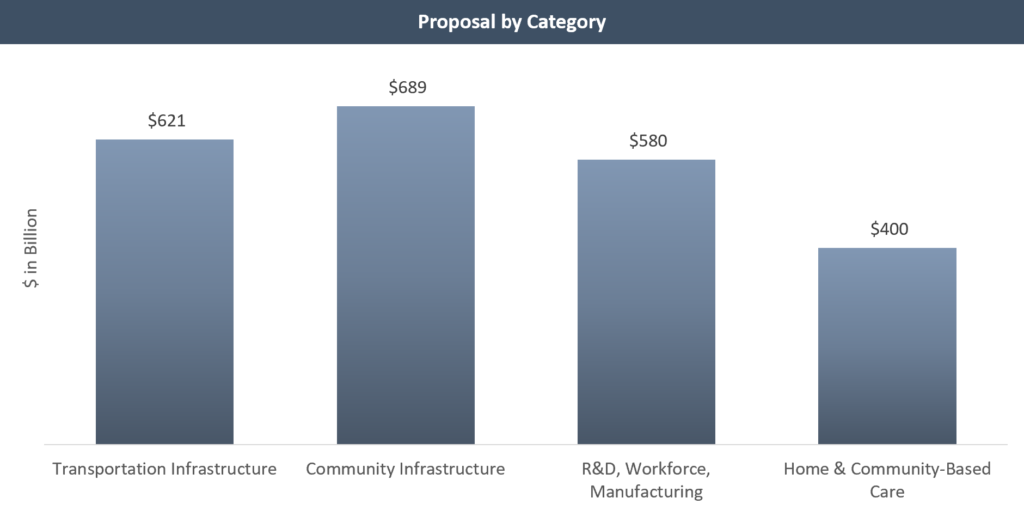

President Biden wants to spend ~$2 trillion on infrastructure and jobs, calling it the “largest American jobs investment since World War II.” The American Jobs Plan, the centerpiece of Biden’s economic agenda, pledges $2.3 trillion in new spending over eight years to accomplish its stated goals. The plan earmarks several billion dollars to improve the nation’s electric power grid, wastewater infrastructure, and broadband networks. The plan includes everything from infrastructure repairs to community-based care, and can be summarized as covering the following 4 main areas: 1)Transportation Infrastructure ($621B) 2)Community Infrastructure ($689B) 3)Research & Development, Workforce Development, and Manufacturing ($580B) 4)Home & Community-Based Care ($400B)

In the next few paragraphs we take a deeper dive into each of these four categories and the implications of each on the relevant infrastructure markets.

Transportation Infrastructure – $621 Billion

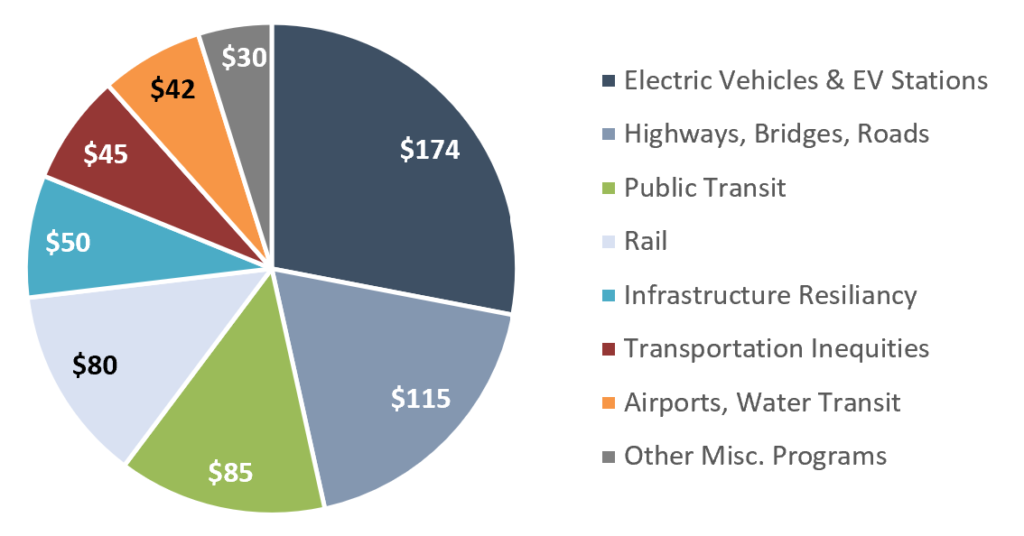

The Plan would make a massive investment in the nation’s roadways, railways, and bridges – roughly ~$174B would be invested in electric vehicle infrastructure. $115B would be spent on repairing roads and bridges, including 20,000 miles of highways and roads. Another $85B is set aside for modernizing transit systems and $80B for Amtrak repairs and route improvements.

President Biden is calling for $50B in dedicated investment to improve infrastructure resilience and protect against fires, floods, and other acts of nature – in 2020, the United States endured 22 separate billion-dollar weather and climate disasters, costing $95 billion in damages.

$45B is budgeted to redress inequities and build the future transportation infrastructure by reconnecting neighborhoods cut off by historic investments and sponsoring new projects.

The Plan calls for a $42B investment in airport and waterway improvements to position the United States as a global leader in transportation infrastructure.

Community Infrastructure – $689 Billion

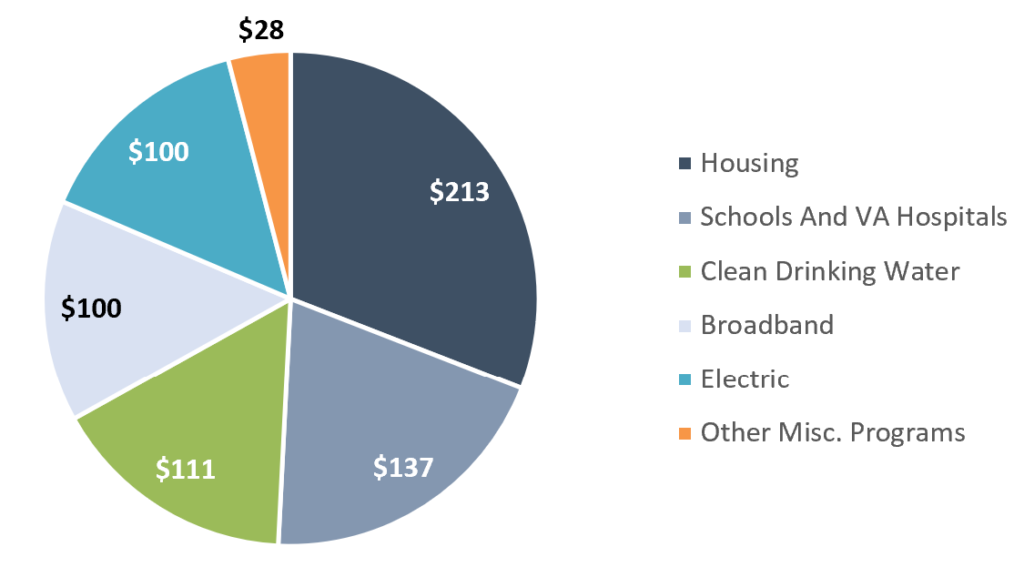

The largest part of the plan would focus on underground water infrastructure, broadband expansion, homes, and school buildings. The plan would invest $213B in housing and other buildings to build, preserve, and retrofit more than 2 million affordable homes and commercial buildings. $137B is budgeted for modernizing schools, childcare centers, and VA hospitals.

$111B of the plan would go toward clean drinking water, with $45B of that amount used to replace lead pipes and service lines. A key objective here is preventing future crises such as what happened over the past decade in Flint, Michigan and Newark, New Jersey. Other upgrades would include stormwater and wastewater system improvements.

The plan also includes a proposal to revitalize America’s digital infrastructure and make high-speed broadband accessible to all Americans with an estimated $100B price tag.

Another $100B would be spent to upgrade the country’s aging electric grid – A Department of Energy study found that power outages cost the U.S. economy up to $70B annually, which could be minimized with a more resilient grid.

Research & Development, Workforce Development, and Manufacturing – $580 Billion

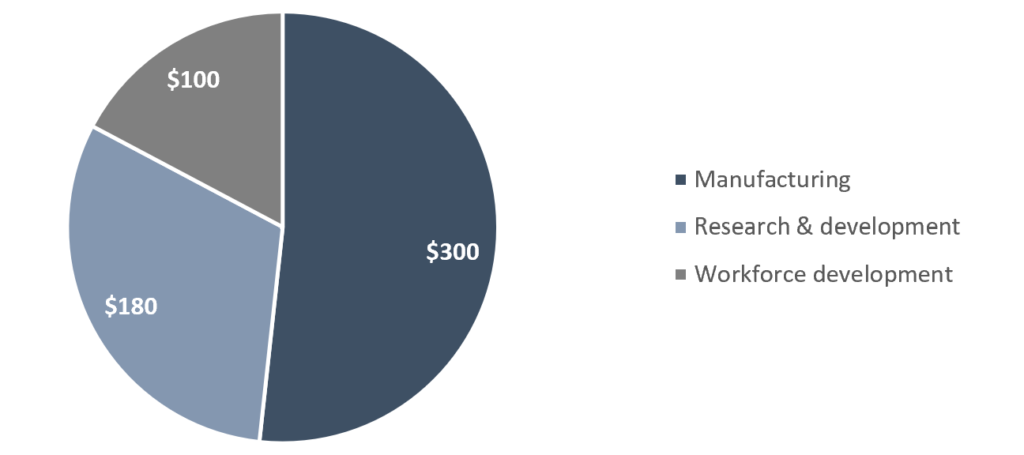

$300 billion of the plan would be invested in semiconductor manufacturing, medical manufacturing, clean energy, rural community small businesses, and regional innovation hubs. The proposal requests that $46B of the manufacturing budget be allocated towards federal purchases of electric cars, charging ports, and electric heat pumps to boost the clean energy industry.

The $180B R&D portion of the bill includes a major clean-energy effort to reduce emissions, boost climate research, and build climate related resilience into infrastructure. The plan seeks to establish the U.S. as a leader in climate science, innovation, and R&D.

Roughly $100B would be used for workforce development in low-income and underserved communities to assist dislocated workers and put students on career paths before graduating from high school. The plan will pair job creation efforts with next generation training programs, target workforce development in underserved communities, and expand the capacity of existing workforce development/protection systems.

Home & Community-Based Care – $400 Billion

The Plan proposes investing $400B to improve access to affordable, quality home or community-based care for the elderly and people with disabilities. Some of the funds would be used to extend a Medicaid program to make more services available – President Biden believes more people should have the opportunity to receive care at home or in a supportive community. The plan will extend the longstanding Money Follows the Person program that supports innovations in the delivery of long-term care and allows people in nursing homes to move back to their own homes. Putting in place an infrastructure to create good middle-class jobs would improve working conditions and wages for essential home care workers. The home and community-based care expansion will yield significant economic benefits for low-income communities and communities of color.

Key Takeaways for the Energy & Industrial Services Industry

Water Infrastructure Investment – Many water mains and pipes were laid in the early to mid 20th century with a lifespan of 75-100 years and significant investment is needed to refresh this vital infrastructure.

Electrical Power Grid Investment – A large portion of T&D infrastructure is reaching the end of its useful life – investment is needed to meet increased electricity demand, replace and upgrade existing infrastructure, and to increase grid reliability.

Broadband Network Investment – As COVID-19 forced many Americans to work and learn from home, the importance of reliable high-speed Internet highlighted the digital divide. 62% of rural Americans have poor internet connection and additional investment is needed in order to provide reliable connectivity nation-wide.

Paying for the Plan

The Made In America Tax Plan

Biden outlined the Made In America Tax Plan that the planners estimate will generate $2 trillion over the course of 15 years and incentivize job creation in the U.S. through the following tax provisions:

1) Increase the corporate tax rate from 21% to 28% – a percentage that the White House noted is still below what corporations paid prior to President Trump’s tax cuts in 2017

2) Increase the global minimum tax on U.S. multinational corporations from 10.5% to 21% in an effort to end perceived preferential tax rates for offshore profits

3) Enact a 15% minimum tax on large corporations’ book income – Democrats intend to target companies that reported large net profits while paying little or no federal income tax; however, few details on the minimum book tax have been provided

4) Prevent U.S. corporations from inverting or claiming tax havens as their residence – Under current law, U.S. corporations can acquire or merge with a foreign company to avoid U.S. taxes by claiming to be a foreign company, even though their place of management and operations are in the United States

5) Discourage offshoring jobs and incentivize onshoring

6) Eliminate tax preferences for the fossil fuel industry

7) Increase IRS funding to ensure the agency is able to increase tax audits on corporations

The Made in America Tax Plan is Phase One of a broader, two-pronged tax initiative. Proposals relating to individual taxation are expected to be included in Phase Two of the initiative to be unveiled in the coming weeks – while we don’t know much about individual income tax implications currently, Biden made it clear during a March 31st address that no one making under $400,000 will see their federal taxes increase.