Recent Take-Private Software Transactions Are Creating an Attractive Outlook for Add-On M&A Activity in 2023

By: Billy Pritchard & Tate Fowler

Once full-year data is officially aggregated and reported, it will be no surprise that 2022 will be viewed as a down year for M&A activity across all industries, with private software transactions declining significantly. During the first three quarters of 2022 756 SaaS M&A transactions closed, a ~17% reduction in volume from the previous year period during 2021.

There was a convergence of well-known and highly discussed factors that led to this downturn in the software space:

- Deal volumes surged to likely unstainable levels in Q4 2020 and FY 2021 due to strong macro tailwinds (i.e., proposed tax legislation changes and low interest rates)

- The public market correction for key software comparables in Q2 and Q3 2022 created market uncertainty, and

- The tightening of debt markets created additional valuation pressure for both strategic and financial buyers

However, a few themes have emerged that give 2023 the potential for a more positive outlook, depending on the deal size and desired transaction structure of a seller. One of those themes that we are tracking is the uptick in take-private software transactions in 2022. This surge in take-private activity comes from a combination of public market corrections coupled with the elevated amount of private equity dry powder.

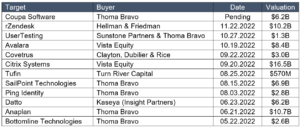

Earlier this week, Thoma Bravo announced that it entered into a definitive agreement to buy Coupa Software, a notable public comp that we track in our Supply Chain Software index. Coupa joins a large list of public peers acquired (or pending acquisition) by private equity firms. Below is a look at several other noteworthy take-private deals over the last several months:

We believe that this uptick in take-private software acquisitions will lead to a much more active market for smaller software deals that are seen as an add-on investment for a larger platform. Certainly, these private equity groups are seeking to deploy capital in what they view as undervalued assets due to the public market selloffs. However, they also see the ability to accelerate future growth as a key part of their deal thesis. Traditionally, these larger PE buyout firms move quickly to deploy several growth initiatives following a take-private deal, and the M&A playbook is typically the leading inorganic initiative. We expect these platforms to aggressively seek add-ons to grow scale, fill product gaps, and expand wallet share with existing customers. A well-executed M&A strategy will be key to a group like Thoma Bravo hitting a return model that allowed them to pay a 77% premium to Coupa’s closing share price on November 22, 2022.

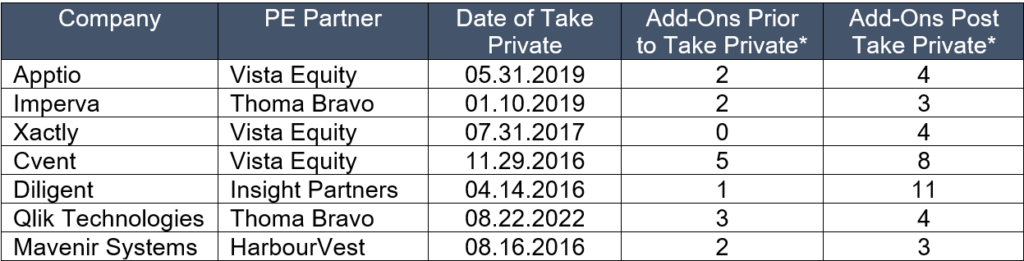

Below is a look at several historical take-private software acquisitions and the ramp-up of M&A activity following the deal:

*Three years pre and post transaction aaaaaaaaaaa

As the trend shows, a PE partner can bring the right team and capital to the table to successfully build scale through an M&A pipeline. For founders of SaaS businesses in the $5 – $15 Million ARR range, we believe that these PE-backed strategic buyers (often referred to as Hybrid Buyers in our process) can be a strong opportunity in 2023.

If you or someone you know have questions regarding anything discussed, or the general SaaS marketplace, please feel free to reach out to Zane Tarence, Partner and Head of Founders’ Tech & Business Services Group.